India stands at the forefront of the digital revolution, marking itself as one of the fastest-growing digital economies worldwide. With over 117 billion digital payment transactions recorded in 2023, and an average of 380 million transactions per day by December 2023, the country's trajectory towards digital integration is unmistakable. Central to this digital transformation is the Unified Payment Interface (UPI), developed by the National Payments Corporation of India (NPCI), embodying India's rapid embrace of digitalization to simplify financial transactions across the board.

UPI: The Cornerstone of Digital Payment in India

What Is UPI?

UPI stands as a beacon of innovation in real-time payment systems, facilitating inter-bank peer-to-peer (P2P) and peer-to-merchant transactions through a seamless two-click factor authentication process. Governed by the Reserve Bank of India (RBI), UPI's framework enables transactions via a smartphone application, heralding a new era of banking and financial services. Its resemblance to Singapore's PayNow underscores a global shift towards government-led digital payment solutions, fostering an ecosystem where transactions are not just secure but also universally accessible.

Embracing Digital Payments: User Trends and Preferences

In 2023, UPI transactions have seen remarkable growth, with the total transactions processed by UPI standing at 117.6 billion for the year. Specifically, for December 2023, UPI payments in India reached 12.02 billion transactions, with payments worth Rs 18.23 lakh crore being processed in just that month. This represents a 54% year-on-year growth in terms of volume and a 42% growth in transaction value annually (Economic Times) The adoption of UPI spans across diverse demographics, with its popularity not confined to urban centers but also penetrating rural areas, demonstrating the platform's wide acceptance and adaptability.

UPI's International Footprint: Bridging Global Transactions

International Payment with UPI:

The international operations of UPI have notably expanded beyond its initial reach. As of the latest updates in 2024, UPI's global footprint has extended to several new countries, making it a more versatile option for international payments. Specifically, France has recently adopted UPI, joining other countries like Bhutan, the United Arab Emirates (UAE), Malaysia, Singapore, Nepal, Oman, Qatar, Russia, Sri Lanka, Mauritius, and the United Kingdom in embracing this system. These expansions underscore UPI's growing acceptance and its potential as a global payment gateway.

This broadened adoption facilitates cross-border transactions, allowing users in these countries to leverage UPI for seamless and secure payments. The collaboration with various international partners and payment providers highlights UPI's versatility and its capability to streamline payment processes across different markets. This development is part of the National Payments Corporation of India's (NPCI) ongoing efforts to extend UPI's reach, reflecting the platform's potential to influence the global digital payment ecosystem significantly.

Cross-border Transactions with UPI: A Closer Look

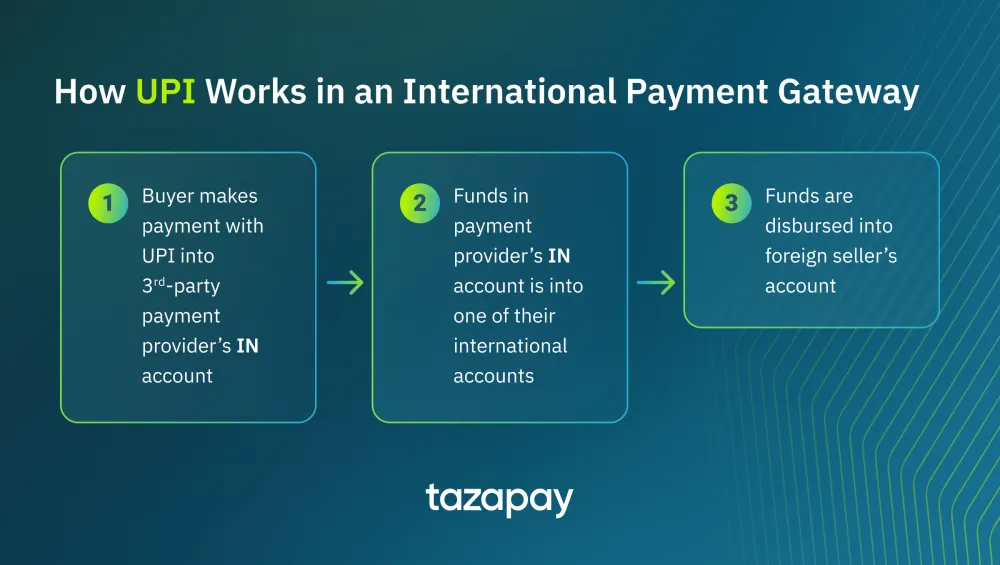

For regions yet to establish direct UPI connectivity, international transactions are streamlined through third-party payment providers, acting as bridges between UPI and global markets. Here’s how the process unfolds:

Initiating Payment: Users initiate transactions by transferring funds to the payment provider's bank account in India via UPI. This is typically done by scanning a QR code or barcode within the UPI app, representing the transaction amount.

Global Fund Transfer: Subsequently, these funds are transitioned into one of the payment provider’s international accounts. The final step sees the funds disbursed to the recipient's bank account abroad, completing the international transaction.

This model exemplifies UPI's adaptability and its growing acceptance as a versatile solution for international payments, providing a seamless, secure, and efficient transfer mechanism across different geographies.

Choosing the Right Payment Provider

Given the diverse landscape of third-party payment providers facilitating UPI transactions internationally, businesses and individuals are advised to select partners offering comprehensive support for a wide range of localized markets. This ensures not only the broad usability of UPI across various international platforms but also enhances the efficiency and security of cross-border payments.

With ongoing discussions to further expand UPI's reach to additional countries, the future of international digital payments looks promising, positioning UPI at the forefront of the global digital economy's evolution.

Analyzing UPI: Benefits and Challenges

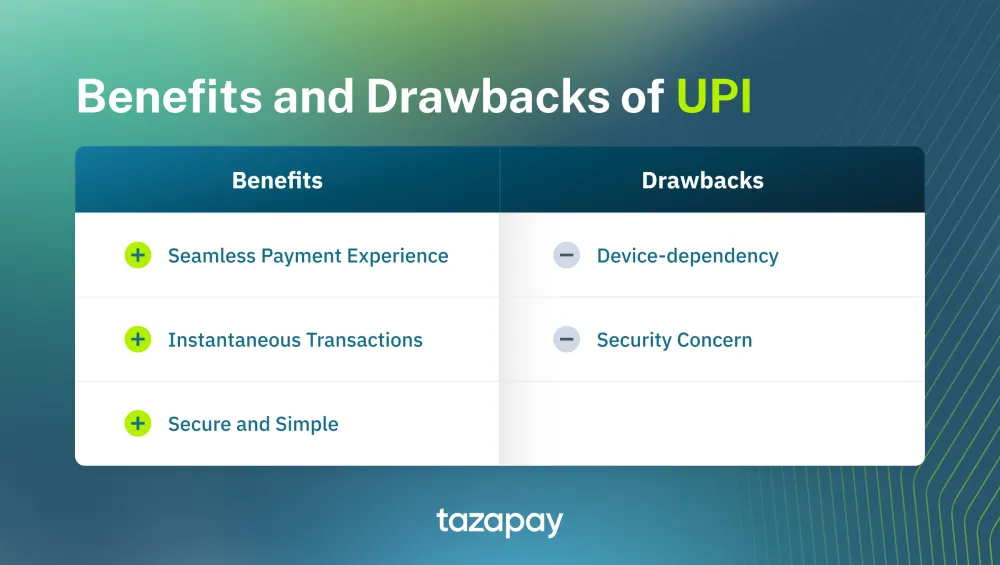

Benefits of UPI:

Seamless Payment Experience: UPI's integration with numerous payment apps and digital wallets, alongside its vast network of banks, provides a hassle-free transaction process.

Instant Transactions: The real-time processing capability of UPI ensures transactions are completed within seconds.

Security and Ease of Use: Enhanced with two-factor authentication and a unique UPI ID, the platform guarantees a secure yet straightforward payment experience.

Drawbacks of UPI:

Dependence on Internet Connectivity: The efficacy of UPI is contingent on reliable internet access, limiting its use in connectivity-challenged regions.

Security Concerns: Despite robust security measures, users must remain vigilant against potential phishing and fraud attempts due to the PIN-based authentication system.

Understanding Taxation and Compliance in UPI Transactions for International Businesses

Expanding into India's digital market requires a keen understanding of the country's tax and compliance landscape, especially for SaaS companies and digital eCommerce merchants leveraging UPI for transactions. Critical to this expansion is navigating the intricate documentation requirements, including obtaining a Tax Residency Certificate (TRC) and making a No Permanent Establishment (PE) Declaration, among others. These steps are vital for leveraging tax benefits under Double Taxation Avoidance Agreements (DTAAs) and ensuring smooth operation within the legal framework.

Furthermore, the implementation of GST on digital services and the significance of the Equalisation Levy on foreign e-commerce transactions underscore the evolving tax regime in India. These measures aim to ensure a level playing field between domestic and international players in the digital economy. As such, international businesses must stay abreast of these regulations to optimize their tax liabilities and maintain compliance. Download our eBook to understand this in detail

For businesses looking to streamline this process, leveraging platforms like Tazapay can provide significant advantages. Tazapay simplifies the complexities of tax collection, compliance, and remittance, enabling businesses to focus on growth and market penetration rather than administrative burdens.

Future Outlook: UPI’s Role in the Global Digital Economy and Tazapay’s Integration

As the Unified Payment Interface (UPI) continues to evolve, its influence is set to extend beyond the Indian market, marking a significant shift in the global digital payment ecosystem. UPI’s initiatives aimed at expanding its international reach and enhancing its features for global usability are pivotal. In this landscape of growth and innovation, UPI is well-positioned to facilitate seamless and secure online payments on a worldwide scale, embodying India's ambitious vision for a digitally empowered global economy.

In this evolving scenario, Tazapay stands out as a crucial player, offering an innovative solution that integrates UPI alongside other local payment options across 80+ locations with just one integration. This strategic collaboration enables businesses to leverage UPI’s simplicity and security while also accessing a broad spectrum of payment methods globally, ensuring they can meet the diverse preferences of customers worldwide. Tazapay's one-stop payment solution signifies a leap towards creating a more inclusive and accessible digital payment infrastructure, making it easier for businesses to engage in cross-border commerce without the hassle of managing multiple payment integrations or local entities.