In cross-border trade, money doesn’t simply move — it passes through a network of banks and intermediaries, each taking a small cut. Those seemingly minor deductions add up fast.

According to McKinsey’s Global Payments Report 2023, over $250 trillion in cross-border payments flow worldwide every year — and a significant portion of that value erodes through FX markups, double conversions, and delays. For exporters, SaaS firms, fintechs, and digital marketplaces, these invisible losses directly reduce profit margins.

Most businesses don’t notice until they reconcile. The reason? Every unnecessary conversion or intermediary hop means lost value. Virtual accounts change that.

FX losses rarely stem from bad luck — they come from how traditional systems handle money movement:

Even a 1–2 % FX spread across large volumes can cost hundreds of thousands annually.

A virtual account is a named, multi-currency account issued under your business name — without needing a local entity in each country.

With Tazapay, businesses can:

For example, an exporter serving clients in the US, EU, and Singapore can receive USD, EUR, and SGD into corresponding virtual accounts, hold those balances, and later pay suppliers in USD or INR — all from one dashboard.

By choosing when and how to convert, businesses protect their margins instead of surrendering them to intermediaries.

You might be facing hidden FX losses if:

If these sound familiar, consolidating your treasury with virtual accounts can restore visibility and control.

A $100,000 invoice illustrates the difference:

This direct-to-account model increases transparency, accelerates settlements, and helps finance teams plan conversions strategically instead of reactively.

The future of cross-border payments is about unifying the collect–hold–pay cycle under one infrastructure.

Tazapay brings these pieces together:

This unified approach enables exporters, SaaS firms, marketplaces, and fintechs to manage global transactions seamlessly. It’s not just faster — it’s smarter, designed to retain more of every dollar earned.

Controlling conversions isn’t just cost-saving; it’s strategy. By holding balances and converting when rates are favorable, companies can improve realized value across markets.

Delaying a USD → INR conversion by even 48 hours can shift returns by up to 1 %, enough to cover multiple transaction fees. The difference lies in timing — and infrastructure that gives you that choice.

FX losses are a symptom of fragmented global banking. Virtual accounts centralize collections, reduce unnecessary conversions, and restore margin control.

The future of money movement isn’t just global — it’s intelligent, connected, and designed to keep value within your business.

Expanding across borders should be exciting for exporters — not overwhelming.

Yet for many Brazilian businesses selling to buyers in India, one of the biggest barriers isn’t logistics or marketing. It’s getting paid efficiently.

Cross-border payment systems remain complex, slow, and costly. Funds often pass through multiple intermediaries, currencies are converted prematurely, and reconciliation becomes a painful manual process.

This is where virtual accounts — a cornerstone of modern global money movement — are transforming how exporters collect payments internationally.

Brazil and India are two of the fastest-growing emerging markets, together representing a bilateral trade value of over USD 11 billion in 2024 (Trading Economics).

But while goods move smoothly, payments lag behind.

Brazilian exporters selling to Indian buyers often face:

These friction points aren’t unique to Brazil and India — they exist across many emerging trade corridors where domestic payment rails dominate but aren’t easily accessible to foreign exporters.

.png)

Traditional trade banking systems were never built for real-time commerce. They work for large institutional transactions but are inefficient for exporters handling frequent or high-value payments across multiple buyers and markets.

Virtual accounts change that by giving businesses local-like access to global collections — without the need to establish or maintain local registered entities in each country.

With a single Tazapay account, exporters can:

This means a Brazilian exporter can now receive funds from an Indian buyer in INR via a local transfer — just like a domestic business would — while managing everything seamlessly through Tazapay.

A sustainable packaging manufacturer in São Paulo has multiple Indian buyers. Previously, these buyers paid via international wire, with funds arriving several days later, minus significant bank and FX fees.

Now, using Tazapay’s Global Collection Account, the exporter can:

The result: faster settlement cycles, reduced FX exposure, simpler reconciliation — and more liquidity for reinvestment.

1. Predictable cash flow

Faster collections mean exporters can plan shipments, inventory, and restocking with greater confidence.

2. No need for a local entity

Virtual accounts let exporters receive local payments without opening a local entity or subsidiary in every market.

3. Transparent FX conversion

Funds can be received in INR and converted when the exporter chooses — not when intermediaries decide.

4. Better buyer experience

Buyers prefer local payment options because they’re faster, cheaper, and require no international setup. That convenience builds trust and repeat business.

5. Easier scaling across markets

Once it works for one corridor, exporters can replicate it in others — such as Singapore, Indonesia, or the UAE — using the same unified account structure.

The rise of virtual accounts represents more than just a collection upgrade — it’s part of a larger shift toward global money movement.

Modern trade is moving away from fragmented, bank-dependent systems toward integrated fintech-led infrastructures that connect local payment methods, multi-currency accounts, and global payouts.

This ecosystem lets businesses collect, hold, and pay in the currencies they need — creating true interoperability between local and international finance.

Platforms like Tazapay are at the center of this evolution:

This isn’t only about speed — it’s about enabling financial inclusion in global trade, allowing exporters of any size to operate with the same efficiency as multinational companies.

SWIFT and wire transfers remain reliable and widely trusted for global settlements, especially for large-value transactions or corridors where local rails are limited.However, virtual accounts provide a faster and more flexible alternative — especially when exporters need visibility, speed, and control. You can read more about it here.

Emerging markets such as Brazil, India, Indonesia, Vietnam amongst others are driving global trade growth but still operate within asymmetrical payment systems.

While domestic innovations like PIX in Brazil and UPI in India have improved local efficiency, cross-border settlements continue to rely heavily on legacy systems.

By combining local collection rails with virtual accounts, exporters can now receive payments globally — without the friction of opening multiple bank accounts or creating local entities in every market.

These capabilities are particularly powerful for B2B exporters, digital marketplaces, and SMEs handling both small and large international payments.

Within days, exporters can move from fragmented systems to a fully integrated global collection framework — the foundation of modern money movement.

For Brazilian exporters — and any business expanding across emerging markets — the difference between slow, manual banking processes and instant, transparent collections is the difference between growth and limitation.

Virtual accounts remove unnecessary friction, empower exporters to collect locally, and bring cross-border trade into real time.

They’re more than a product feature; they’re the future of how businesses collect, hold, and move money globally. And for exporters ready to simplify their next chapter of growth, that future is already here.

Expanding globally isn’t only about finding new customers. It’s also about how easily you can pay the people who keep your business running — sellers, vendors, suppliers, and partners around the world. For B2B companies, payouts are one of the most important parts of building trust and keeping relationships strong.

The challenge is that many businesses still face high fees, banking delays, and a lack of visibility when sending money across borders. The good news is that smarter payout methods are now making it possible to cut costs while giving sellers and vendors a smoother, more reliable experience.

International payouts have long been weighed down by inefficiencies. SWIFT and wire transfers often move through several banks before reaching the final recipient, and each step adds fees. Foreign exchange spreads can also reduce the final amount received. When you’re sending payouts at scale, these costs add up quickly.

For sellers, vendors, and suppliers, payouts are more than just transactions — they’re a sign of trust in the company they work with. When payments are late or unclear, confidence in that relationship weakens. Common frustrations include:

Companies that solve these problems don’t just save costs; they build stronger, more reliable relationships with their global network of sellers and vendors.

.png)

The most common ways businesses send cross-border payouts today are through local bank transfers and SWIFT or wire transfers. Alongside these, newer options like stablecoin-to-fiat payouts are helping businesses remove banking delays and avoid extra costs.

Local bank transfers

By working with licensed partners in each country, payouts can move directly through local banking networks. This usually means lower transaction fees, faster settlement times, and fewer surprises for the recipient subject to the local bank’s cut-off time.

SWIFT and wire transfers

SWIFT and wires remain the backbone of many international payouts. They’re secure and widely accepted, especially for corridors where no local alternative exists with the option of sending out large payments. While they can take longer and involve more fees than local transfers, costs can be reduced by using payout providers that optimize routes and minimize intermediary bank charges.

Stablecoin to fiat payouts

Smarter payout methods are also emerging. Stablecoins allow value to move almost instantly, without the usual banking delays or intermediary deductions. With the right infrastructure, they can be converted directly into any supported local currency, so sellers and vendors always receive fiat in their accounts. Tazapay supports this flow, giving businesses more flexibility while reducing unnecessary costs and delays.*

Reducing costs is important, but speed and reliability matter even more to sellers and vendors. A strong payout experience usually comes down to:

Managing payouts across multiple countries and currencies isn’t simple. It requires more than just moving money — it calls for compliance, automation, and a partner that can handle scale.

Tazapay brings all of this together. We support local bank transfers, SWIFT/wire transfers, and stablecoin-to-fiat payouts, all managed through a single dashboard. Businesses gain efficiency and compliance, while sellers, vendors, and suppliers receive a reliable experience they can count on.

Cross-border payouts are no longer just an operational detail. They directly shape how sellers, vendors, and suppliers see your company and whether they continue working with you. By combining local bank transfers, SWIFT, and smarter options like stablecoin-to-fiat, businesses can reduce costs, avoid unnecessary delays, and deliver a payout experience that grows with them.

👉 Learn more about Payouts with Tazapay and how we help businesses streamline global payouts at scale.

*Stablecoin services are offered through Tazapay Canada Corp.

Thailand is one of Southeast Asia’s fastest-growing digital economies. With a population that is increasingly mobile-first, digital payments are now part of everyday life. For international businesses selling to Thai customers, however, the biggest challenge remains checkout success.

Credit and debit cards remain important, but they often fall short. Many transactions are declined, card coverage is limited outside urban centers, and foreign exchange costs can discourage buyers. This results in abandoned checkouts and lost revenue opportunities.

PromptPay, Thailand’s national QR-based payment method overseen by the Bank of Thailand and National ITMX, has become the mainstream alternative. With more than 81 million registrations and billions of transactions every month, it is trusted by consumers across all sectors.

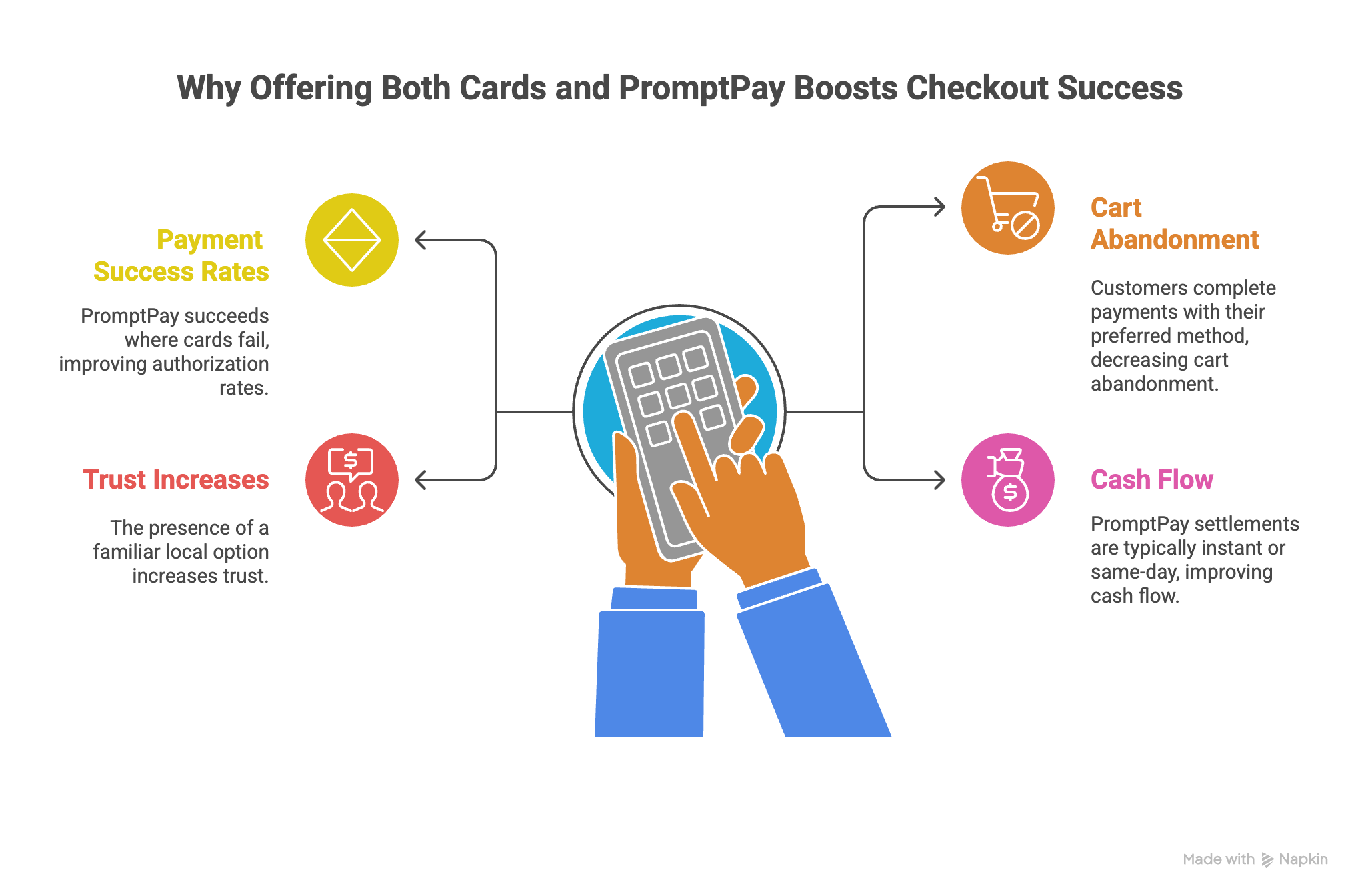

For global B2B and e-commerce businesses, enabling PromptPay alongside cards means fewer failed payments, higher authorization rates, and greater customer trust.

With Tazapay, you can offer PromptPay through a unified checkout that also supports cards and 80+ other local payment methods, going live within days.

PromptPay adoption has grown dramatically, making it an indispensable part of Thailand’s payment ecosystem:

This progression shows PromptPay’s journey from a domestic initiative to a critical tool for international businesses. Offering PromptPay at checkout has become an expectation, not a differentiator, for global merchants operating in Thailand.

.png)

E-commerce platforms and online marketplaces often see high cart abandonment in Thailand due to card failures or customer hesitation.

By offering PromptPay alongside cards:

PromptPay has become a default option for Thai shoppers, so businesses that include it maximize completed orders and revenue.

Thailand’s travel industry is huge, and online booking platforms often face failed transactions at checkout. This is particularly challenging for mid-range purchases like hotel reservations or tour bookings.

PromptPay helps by:

For online travel agencies and hotel platforms, PromptPay improves booking completion and reduces drop-offs.

Thailand has one of Asia’s most engaged digital populations, with significant spending on gaming and online products. But micro-transactions and one-off purchases often fail on card-only checkouts.

PromptPay ensures:

This makes PromptPay especially valuable for digital platforms, app stores, and gaming companies serving Thai customers.

As online education grows in Thailand, payment access remains a barrier. Many students and professionals lack international-ready cards, making it difficult to enroll in global courses.

PromptPay solves this by:

Businesses that provide multiple payment options serve more customers and reduce payment risk. In Thailand:

PromptPay complements cards rather than replacing them. Together, they capture the widest possible customer base and maximize checkout success.

Merchants relying only on cards or international transfers face:

Adding PromptPay addresses these risks and future-proofs your checkout strategy.

Tazapay simplifies the complexity of enabling PromptPay for cross-border businesses:

Whether you prioritize speed or brand control, Tazapay gives you the flexibility to add PromptPay and optimize checkout for higher authorization rates and faster settlement.

Thailand’s digital economy offers huge opportunities for global businesses, but only if they solve checkout friction. Cards remain necessary, but PromptPay has become an equally important option.

With more than 81 million registrations and over 2 billion monthly transactions in 2025, PromptPay is one of Thailand’s most trusted and widely used payment methods. Businesses that offer it alongside cards increase conversions, reduce abandonment, and build stronger customer trust.

With Tazapay, you can integrate PromptPay quickly and compliantly, enabling a better checkout experience for your Thai customers.

Ready to start? Talk to Tazapay and enable PromptPay today.

South Korea is a global leader in digital commerce, boasting one of the highest internet penetration rates and mobile adoption rates in the world.

However, succeeding in this digitally advanced economy demands more than just offering international card acceptance — it requires local adaptation, especially when it comes to payments.

Unlike Western markets where Visa, Mastercard, and PayPal dominate, Korean consumers strongly prefer domestic payment options.

More than 70% of online transactions in South Korea are processed through local digital wallets such as NaverPay, KakaoPay, and SamsungPay.

Recognizing this need for localization, Tazapay now enables merchants to offer Korea’s most trusted local payment methods — making entry into the Korean market simpler, faster, and operationally efficient.

International merchants can now accept payments through:

Through a single integration with Tazapay, businesses can offer these payment methods without needing to establish a local entity, open domestic bank accounts, or sign separate acquiring contracts.

South Korean consumers expect — and often require — familiar domestic payment methods at checkout.

Failure to offer recognizable options results in:

Conversely, merchants who localize their checkout experience by offering domestic wallets and local cards see:

The message is clear: adapting to local payment preferences isn't just operationally smart — it's commercially critical.

Tazapay’s platform architecture is built to remove traditional barriers to global expansion.

Through Tazapay, merchants can:

This Collect-Hold-Pay capability — unified under one platform — allows merchants to manage incoming funds and outgoing disbursements without multiple vendor relationships, reconciliations, or compliance overhead.

Simpler Onboarding:

Checkout Localization:

Optimized FX Management:

Improved Cash Flow:

Reduced Compliance Risk:

Operational Simplicity:

By centralizing these capabilities, merchants save on setup costs, legal complexity, and operational drag — accelerating their ability to capture market share in Korea.

South Korea continues to be a high-growth, digitally sophisticated market.

Mobile payments, domestic digital wallets, and local payment rails are the standard — not the exception — for Korean consumers.

International merchants who localize their payment strategies now will be better positioned to:

With Tazapay’s latest launch, expanding into South Korea has never been simpler.

One platform. One contract. Full access to Korea’s preferred payment options — without local entity setup or operational complexity.

👉 Start collecting Korean local payments today with Tazapay.

In the rapidly evolving digital economy of East Asia, understanding local payment methods is crucial for businesses aiming to penetrate these markets. With a significant portion of consumers favoring digital wallets and alternative payment solutions over traditional card systems, adapting to these preferences is essential for both local and international enterprises. This comprehensive guide delves into the most preferred payment methods across key East Asian countries, highlighting their penetration rates, ease of use, and strategic advantages for businesses.

Alipay, launched by Alibaba Group in 2004, has grown into one of the world's largest mobile payment platforms. It offers a comprehensive suite of financial services, including payments, money transfers, and wealth management. As of 2025, Alipay boasts over 1.2 billion users globally, with a significant concentration in China. Users can effortlessly link their bank accounts or cards to the app, facilitating seamless QR code-based transactions both online and offline. For international businesses, integrating Alipay as a payment option opens access to a vast consumer base accustomed to this platform, enhancing transaction convenience and customer trust. Notably, American Express has partnered with Alipay, allowing global cardholders to link their cards to the Alipay digital wallet, simplifying transactions for travelers and providing local businesses with greater opportunities to attract international customers.

Embedded within the ubiquitous WeChat app, WeChat Pay has seamlessly integrated social media with financial transactions. With over 1.3 billion monthly active users, WeChat Pay facilitates peer-to-peer transfers, bill payments, and in-store purchases through QR codes (source). Its integration into daily communication platforms makes it indispensable in Chinese consumers' lives. International businesses targeting Chinese customers can leverage WeChat Pay to offer a familiar and efficient payment method, thereby enhancing user experience and potentially increasing conversion rates.

UnionPay, established in 2002, is China's largest card payment organization, with cards accepted in over 180 countries. While digital wallets dominate urban areas, UnionPay remains prevalent, especially among older demographics and in regions where mobile payments are less ubiquitous. For businesses, supporting UnionPay ensures accessibility to a broader audience, including those who prefer traditional card payments. Additionally, UnionPay's collaboration with various international payment networks facilitates smoother cross-border transactions.

Introduced in 2018, PayPay has rapidly become one of Japan's leading mobile payment apps, boasting over 50 million users. It offers QR code-based payments, promotions, and a user-friendly interface, encouraging cash-reliant consumers to adopt digital payments. For international businesses, integrating PayPay can attract Japanese customers who prefer this method, especially in e-commerce and retail sectors. Its growing acceptance across various merchants signifies a shift towards cashless transactions in Japan.

Rakuten Pay, part of the Rakuten ecosystem, allows users to make payments using linked credit cards or Rakuten points. Its integration with Rakuten's e-commerce platform provides a seamless shopping experience. International businesses partnering with Rakuten Pay can tap into a loyal customer base familiar with Rakuten's services, enhancing brand visibility and trust. The platform's reward system, offering Rakuten points for transactions, incentivizes repeat purchases.

Originally designed for public transport payments, IC cards like Suica and PASMO are now widely accepted at convenience stores, restaurants, and vending machines across Japan. Merchants benefit from their simplicity—transactions are instant, reducing checkout times significantly. Retailers near transit hubs can capitalize on the popularity of IC cards by offering exclusive discounts or promotions for card users. Suica cards are also compatible with Apple Pay, enhancing their appeal among international tourists.

KakaoPay, launched by Kakao Corporation, integrates seamlessly with KakaoTalk, South Korea's dominant messaging app. It offers services like money transfers, bill payments, and online purchases. With over 36 million users, KakaoPay's convenience and integration into daily communication make it a preferred payment method. International businesses can benefit by incorporating KakaoPay, appealing to tech-savvy consumers who value efficiency and integration. Its rapid adoption reflects South Korea's shift towards a cashless society.

Naver Pay, associated with Naver, South Korea's leading search engine, provides users with a simple payment solution for online shopping and services. By linking bank accounts or cards, users can make swift payments without repeatedly entering payment information. For businesses, integrating Naver Pay can enhance the checkout experience for customers, potentially reducing cart abandonment rates. Its association with Naver's extensive ecosystem offers additional marketing opportunities.

Toss started as a peer-to-peer money transfer service and has expanded into a comprehensive financial platform, including payments, investments, and insurance. With over 20 million users, Toss's user-centric design and broad service offerings make it a significant player in South Korea's fintech scene. Businesses can leverage Toss to offer diverse financial services, catering to consumers seeking integrated financial solutions.

Samsung Pay stands out with its compatibility with both NFC-enabled terminals and traditional magnetic stripe readers via MST technology. This versatility makes it a favorite among South Korean consumers and tourists alike. Merchants benefit from its broad acceptance and secure transaction protocols that minimize chargebacks. Retailers adopting Samsung Pay can cater to a diverse customer base without upgrading their POS systems extensively. Its widespread acceptance makes it an essential payment method for businesses serving South Korean consumers.

Initially launched as a transit card, Octopus has become a widely accepted payment method across Hong Kong, from retail stores to restaurants. Users can top up their cards via cash or digital means, making it an easy-to-use solution for both locals and tourists. Businesses accepting Octopus tap into a vast consumer base familiar with contactless payments.

A localized version of Alipay, AlipayHK serves Hong Kong residents with seamless mobile payments. With over 3 million users, it is commonly used for peer-to-peer transfers, bill payments, and online shopping. Businesses integrating AlipayHK can attract local customers accustomed to digital payments.

WeChat Pay HK offers similar functionality to WeChat Pay in mainland China, with support for local transactions in Hong Kong dollars. It allows businesses to cater to both Hong Kong residents and visiting mainland Chinese consumers who rely on WeChat Pay for everyday transactions.

JKoPay is Taiwan’s leading QR-code-based wallet, with strong adoption in retail and small businesses. JKoPay enables small businesses to go cashless by providing an easy-to-use platform for accepting digital payments. Its growing user base makes it a valuable payment option for businesses expanding into Taiwan.

Line Pay is Taiwan’s most used mobile wallet, embedded in the Line messaging app. With seamless integration into e-commerce platforms, businesses can drive higher conversion rates and customer retention.

Taiwan Pay, backed by the government, promotes financial inclusion and cashless transactions. Businesses accepting Taiwan Pay can cater to a broader audience, including the growing digital-native population.

For merchants eyeing East Asia's lucrative markets, adopting local payment methods is no longer optional—it’s essential for success in this diverse region where consumer preferences vary widely by country but consistently favor convenience and familiarity over global alternatives like credit cards.

By integrating these local payment solutions into their operations, businesses can not only enhance customer satisfaction but also unlock new revenue streams in one of the world’s most dynamic consumer markets!

India stands at the forefront of the digital revolution, marking itself as one of the fastest-growing digital economies worldwide. With over 117 billion digital payment transactions recorded in 2023, and an average of 380 million transactions per day by December 2023, the country's trajectory towards digital integration is unmistakable. Central to this digital transformation is the Unified Payment Interface (UPI), developed by the National Payments Corporation of India (NPCI), embodying India's rapid embrace of digitalization to simplify financial transactions across the board.

UPI stands as a beacon of innovation in real-time payment systems, facilitating inter-bank peer-to-peer (P2P) and peer-to-merchant transactions through a seamless two-click factor authentication process. Governed by the Reserve Bank of India (RBI), UPI's framework enables transactions via a smartphone application, heralding a new era of banking and financial services. Its resemblance to Singapore's PayNow underscores a global shift towards government-led digital payment solutions, fostering an ecosystem where transactions are not just secure but also universally accessible.

In 2023, UPI transactions have seen remarkable growth, with the total transactions processed by UPI standing at 117.6 billion for the year. Specifically, for December 2023, UPI payments in India reached 12.02 billion transactions, with payments worth Rs 18.23 lakh crore being processed in just that month. This represents a 54% year-on-year growth in terms of volume and a 42% growth in transaction value annually (Economic Times) The adoption of UPI spans across diverse demographics, with its popularity not confined to urban centers but also penetrating rural areas, demonstrating the platform's wide acceptance and adaptability.

The international operations of UPI have notably expanded beyond its initial reach. As of the latest updates in 2024, UPI's global footprint has extended to several new countries, making it a more versatile option for international payments. Specifically, France has recently adopted UPI, joining other countries like Bhutan, the United Arab Emirates (UAE), Malaysia, Singapore, Nepal, Oman, Qatar, Russia, Sri Lanka, Mauritius, and the United Kingdom in embracing this system. These expansions underscore UPI's growing acceptance and its potential as a global payment gateway.

This broadened adoption facilitates cross-border transactions, allowing users in these countries to leverage UPI for seamless and secure payments. The collaboration with various international partners and payment providers highlights UPI's versatility and its capability to streamline payment processes across different markets. This development is part of the National Payments Corporation of India's (NPCI) ongoing efforts to extend UPI's reach, reflecting the platform's potential to influence the global digital payment ecosystem significantly.

For regions yet to establish direct UPI connectivity, international transactions are streamlined through third-party payment providers, acting as bridges between UPI and global markets. Here’s how the process unfolds:

Initiating Payment: Users initiate transactions by transferring funds to the payment provider's bank account in India via UPI. This is typically done by scanning a QR code or barcode within the UPI app, representing the transaction amount.

Global Fund Transfer: Subsequently, these funds are transitioned into one of the payment provider’s international accounts. The final step sees the funds disbursed to the recipient's bank account abroad, completing the international transaction.

This model exemplifies UPI's adaptability and its growing acceptance as a versatile solution for international payments, providing a seamless, secure, and efficient transfer mechanism across different geographies.

Given the diverse landscape of third-party payment providers facilitating UPI transactions internationally, businesses and individuals are advised to select partners offering comprehensive support for a wide range of localized markets. This ensures not only the broad usability of UPI across various international platforms but also enhances the efficiency and security of cross-border payments.

With ongoing discussions to further expand UPI's reach to additional countries, the future of international digital payments looks promising, positioning UPI at the forefront of the global digital economy's evolution.

Seamless Payment Experience: UPI's integration with numerous payment apps and digital wallets, alongside its vast network of banks, provides a hassle-free transaction process.

Instant Transactions: The real-time processing capability of UPI ensures transactions are completed within seconds.

Security and Ease of Use: Enhanced with two-factor authentication and a unique UPI ID, the platform guarantees a secure yet straightforward payment experience.

Dependence on Internet Connectivity: The efficacy of UPI is contingent on reliable internet access, limiting its use in connectivity-challenged regions.

Security Concerns: Despite robust security measures, users must remain vigilant against potential phishing and fraud attempts due to the PIN-based authentication system.

Expanding into India's digital market requires a keen understanding of the country's tax and compliance landscape, especially for SaaS companies and digital eCommerce merchants leveraging UPI for transactions. Critical to this expansion is navigating the intricate documentation requirements, including obtaining a Tax Residency Certificate (TRC) and making a No Permanent Establishment (PE) Declaration, among others. These steps are vital for leveraging tax benefits under Double Taxation Avoidance Agreements (DTAAs) and ensuring smooth operation within the legal framework.

Furthermore, the implementation of GST on digital services and the significance of the Equalisation Levy on foreign e-commerce transactions underscore the evolving tax regime in India. These measures aim to ensure a level playing field between domestic and international players in the digital economy. As such, international businesses must stay abreast of these regulations to optimize their tax liabilities and maintain compliance. Download our eBook to understand this in detail

For businesses looking to streamline this process, leveraging platforms like Tazapay can provide significant advantages. Tazapay simplifies the complexities of tax collection, compliance, and remittance, enabling businesses to focus on growth and market penetration rather than administrative burdens.

As the Unified Payment Interface (UPI) continues to evolve, its influence is set to extend beyond the Indian market, marking a significant shift in the global digital payment ecosystem. UPI’s initiatives aimed at expanding its international reach and enhancing its features for global usability are pivotal. In this landscape of growth and innovation, UPI is well-positioned to facilitate seamless and secure online payments on a worldwide scale, embodying India's ambitious vision for a digitally empowered global economy.

In this evolving scenario, Tazapay stands out as a crucial player, offering an innovative solution that integrates UPI alongside other local payment options across 80+ locations with just one integration. This strategic collaboration enables businesses to leverage UPI’s simplicity and security while also accessing a broad spectrum of payment methods globally, ensuring they can meet the diverse preferences of customers worldwide. Tazapay's one-stop payment solution signifies a leap towards creating a more inclusive and accessible digital payment infrastructure, making it easier for businesses to engage in cross-border commerce without the hassle of managing multiple payment integrations or local entities.

.png)

The user experience (UX) of any online business is crucial to its success. A smooth and seamless UX can significantly influence profit margins by reducing cart abandonment rates. As businesses scale, enhancing the UX becomes essential, with a primary focus on upgrading their payment gateways. Initially, a fledgling online business might suffice with a simple payment link due to its straightforwardness and rapid payment processing—key features for those new to eCommerce or starting their digital transition. However, as the business grows, there's a need to adopt more sophisticated solutions like integrated payment gateways or payment APIs.

The shift may seem daunting, especially for new online businesses accustomed to plug-and-play payment apps. Integrated payment gateways often require some technical skill to implement due to their role as intermediary software that facilitates quick, automated payment processes. Fortunately, for those opting for simplicity, hosted checkout APIs present a less intimidating alternative. Hosted by a third-party provider, these APIs integrate effortlessly with existing checkout systems, sparing businesses the complexity of developing their own payment systems from scratch. This approach not only saves time but also demands minimal effort from the merchant for integration, as most services are managed by the third-party provider.

Understanding online checkouts and the workings of hosted payment APIs is vital for any growing online business, preparing them for future expansion and success in the competitive digital marketplace.

The concept of online checkout in an eCommerce store is straightforward: it's the designated 'area' where buyers finalize their purchase of goods or services. This typically involves a dedicated checkout page that presents a variety of payment methods. Despite the diverse nature of eCommerce businesses, catering to both B2C and B2B sectors, the fundamental user experience at checkout remains consistent and generally unfolds as follows:

These core aspects of the online checkout experience are largely uniform across eCommerce stores worldwide. The selection of payment methods available often plays a crucial role in securing a successful sale. This importance stems from user's payment preferences and the tendency to stick with familiar payment methods. For instance, some customers prefer card payments for their ubiquity and convenience, while others might opt for bank redirects due to the direct link with local banks. Offering multiple, especially localized, payment methods can significantly enhance customer retention and satisfaction by catering to these preferences.

.png)

Transactions in eCommerce typically involve two key parties: the seller offering the product/service and the buyer acquiring it. The commonality between them, besides the exchange of legal tender and products, is the necessity for information verification. This includes verifying a seller’s legitimacy for the buyer and a buyer’s identity for the seller. Given the inherent remoteness and anonymity of cyberspace, acquiring detailed information becomes crucial for any successful eCommerce transaction.

As a seller utilizing a hosted payment API, setting up your data on your chosen payment gateway’s database requires just a few commands or calls as outlined in the API documentation provided. For new buyers, you can employ the API call function that creates a new user profile in the payment gateway’s database. For returning customers, a ‘get user’ call function allows you to retrieve the existing buyer details from the database. Additionally, buyer data can be seamlessly saved into the database as they input their information during the first checkout step using the same ‘create user’ API call.

This streamlined process not only ensures secure online transactions but also enhances the online checkout experience, making it smoother and more efficient for both sellers and buyers in the eCommerce environment.

Once both your data (as the seller) and the customer’s data (as the buyer) have been prepared, the next step is to create the underlying transaction for checkout. The process of setting up this transaction can vary depending on your payment provider, so it's crucial to be well-acquainted with your provider's specific terminology and procedures. For initiating checkout, you'll need to understand the terms related to creating a transaction unit versus processing payments. For instance, Tazapay refers to their transaction units as "escrow," so you would initiate a transaction by creating escrow.

Following this setup, you can proceed to integrate your inventory data into the payment gateway. This ensures that the total cart amount is accurately recorded and logged. Such integration not only streamlines the transaction process but also enhances the online checkout experience, ensuring that all details are correctly aligned with the hosted checkout API.

By this stage, the buyer is at the final step of the checkout process, as outlined earlier. While the process may seem complex, it's important to note that most tasks are managed automatically by the API’s protocols, requiring minimal, if any, input from the seller in real time. This ensures a painless, smooth UX).

Once the buyer clicks the purchase button, this should trigger an API call to create a payment page. The specifics of these calls and their functionality vary from payment provider to payment provider. For example, with Tazapay, this function is called ‘create payment,’ as their unit for generating a payment page is termed ‘payment’. Regardless of the nomenclature, the newly-generated payment page is where the buyer completes their transaction using any of the payment methods offered by the payment gateway.

Depending on the payment gateway, you may also have the flexibility to enable or disable payment methods to optimize profitability. If all goes well, the buyer completes their payment, and you, the seller, can proceed with fulfilling the order—shipping the purchased items to the buyer’s address promptly.

Now that you are familiar with the workings of a hosted checkout API, you can approach the selection of a payment gateway with greater confidence, ready to scale and expand your business. Tazapay’s wide range of local and global payment methods, easy API integration, and digital solutions, is poised to help grow your business efficiently.

This approach not only secures the transaction but also optimizes the efficiency and accuracy of the eCommerce payment integration, providing a seamless and reliable service for both sellers and buyers in the digital marketplace.

Contact us to integrate today!

.png)

In the rapidly evolving world of eCommerce, understanding the intricacies of eCommerce payment gateways is crucial for merchants aiming to excel. With a plethora of options available, distinguishing between hosted payment gateways and native payment gateways becomes essential for informed decision-making. This blog delves into the key differences between hosted and native gateways and their unique impacts and benefits.

Hosted payment gateways usher customers to the payment service provider's (PSP) platform to finalize their online payment methods. This off-site processing model ensures robust transaction security and compliance, relieving merchants from the complexities of handling sensitive financial information. The true appeal of hosted gateways lies in their ease of integration and user-friendly payment solutions, making them an ideal choice for businesses seeking a hassle-free setup.

Pros:

Cons:

Native payment gateways keep the entire checkout process on the merchant's domain, affording unparalleled control over the transaction journey. This model favors merchants eager to craft a bespoke customer experience, offering detailed insights into buyer behavior that can refine future marketing strategies.

Pros:

Cons:

The decision between hosted and native payment solutions ultimately depends on your business's unique needs and capabilities. Both gateway types offer distinct advantages and challenges, making it crucial to weigh them in the context of your operational priorities and customer experience with payment gateways. Understanding these differences is key to choosing the right payment gateway for your business, ensuring you select the solution that best fits your transaction security, user experience, and eCommerce success goals.

Tazapay sets itself apart by offering both hosted and native payment gateways, providing unmatched flexibility across 173 markets and enabling 80+ local payment options. This extensive reach, coupled with a seamless onboarding process that eliminates the need for local entities, ensures merchants can easily expand globally without the usual complexities. With Tazapay, integration is just the beginning of a streamlined journey towards international eCommerce success.

Tazapay empowers merchants to exceed the evolving expectations of a diverse customer base. Whether you’re looking to optimize the checkout experience or expand your market reach, we offer the tools and support to achieve your business objectives with efficiency and ease, reinforcing the benefits of user-friendly payment solutions.

Contact us to learn more about our solutions and how you can onboard with us today.

Security is a cornerstone of any successful eCommerce operation. Among the most effective tools in the arsenal against fraud and chargebacks is 3D Secure (3DS) technology. If you've made a card payment online, it's likely you've encountered 3DS—even if you weren't aware of it. Let's delve into how 3DS works and its role in minimizing chargebacks.

3DS is a robust authentication protocol designed specifically for card payments. It hinges on a three-domain model encompassing the Acquirer Domain (merchant’s bank), the Issuer Domain (cardholder’s bank), and the Interoperability Domain (technology facilitating 3DS communication). This protocol is vital for both payment authentication and additional security checks, offering several ways to authenticate:

The essence of 3DS is its requirement for consumers to authenticate their transactions, significantly reducing unauthorized payments and, consequently, chargebacks.

While 2DS offers a simplified, two-domain model for authentication, 3DS presents a more comprehensive approach, including an additional security domain. The primary difference lies in the depth of security and the consumer's interaction with the authentication process, with 3DS requiring an OTP or similar verification method.

The choice between 2DS and 3DS impacts not just security but the overall customer experience. While both aim to secure transactions, 3DS stands out for its ability to prevent various forms of fraud, including 'friendly fraud'—where chargebacks are filed without legitimate grounds. Implementing 3DS can significantly enhance your efforts to mitigate such risks.

However, the effectiveness and preference for 3DS can vary globally. For instance, while some markets like the U.S. may still lean towards 2DS for its simplicity, others, like Singapore, have widely adopted 3DS, appreciating the added security layer of OTP verification. Knowing your target market's preferences is crucial to implementing the most effective payment security strategy.

Familiarity with 3DS and its application in a payment gateway can greatly benefit your eCommerce business by reducing chargebacks and enhancing transaction security. For those seeking a secure, robust payment gateway solution, Tazapay offers a comprehensive suite of features designed to protect your online transactions. Accredited by the Monetary Authority of Singapore (MAS) and equipped with PCI DSS certification, Tazapay ensures your business transactions are secure and trustworthy.

The digital era has opened a world of opportunities for businesses to go global. Yet, the unique digital evolution of each region and country has profoundly influenced consumer preferences in online payments. This diversity has given rise to local payment methods, designed specifically to align with the distinct consumer behaviors across the globe. Understanding what these local payment methods entail and the reasons behind their emergence is crucial for businesses looking to thrive in the international market.

As we embark on the journey to understand the intricacies of local payment options, it's essential to first navigate through the diverse payment landscape that cross-border payments encompass. These payment methods form the backbone of international commerce, facilitating seamless transactions across borders. Let's delve into the key payment options that businesses and consumers commonly utilize in a cross-border context:

Credit Cards: Universally accepted, credit cards stand as a cornerstone in cross-border transactions, offering convenience and security for buyers and sellers alike.

Wire Transfer: For direct bank-to-bank transactions, wire transfers offer a reliable method for transferring funds internationally, albeit often with higher fees and longer processing times.

Local Bank Transfer: Bridging the gap between traditional and digital, local bank transfers provide a method for customers to pay through their local banking systems, enhancing convenience without the need for international banking facilities.

Local Payment Options: Catering specifically to regional preferences and financial infrastructures, local payment options (or alternative payment methods) offer tailored solutions that resonate with the local consumer behavior, ensuring inclusivity and accessibility in the global marketplace.

Local payment methods, distinct from the conventional international payments like credit cards and bank transfers, cater to regional preferences and needs. Known variably as alternative payment methods (APMs), their development is influenced by a myriad of factors including existing infrastructures, consumer behavior, and government policies. The contrast between the Philippines and Ghana illustrates this diversity perfectly; while the Philippines has embraced eWallets for their unbanked population, Ghana leans towards Mobile Money services provided by telecom companies, showcasing the tailored evolution of payment solutions across different landscapes.

Incorporating local payment options into your cross-border payment gateway is not just a nod to customer diversity—it's a strategic move that propels your business forward. This approach does more than just acknowledge the varied preferences of your global customer base; it actively engages with them, offering solutions that are attuned to their specific needs and circumstances. Here are the key benefits of integrating local payment methods into your international payment infrastructure:

Enhanced Customer Experience: By offering payment options that customers are familiar with and trust, you significantly improve the user experience. This familiarity reduces friction at checkout, increasing the likelihood of completing a purchase.

Increased Market Penetration: Local payment methods open doors to new markets, especially in regions with a high preference for non-traditional payment solutions. This inclusivity allows you to reach a broader audience, tapping into previously inaccessible customer segments.

Higher Transaction Success Rates: Local payment options often boast higher success rates for transactions, owing to their compatibility with the regional banking infrastructure and regulatory environment. This leads to fewer failed transactions and a smoother payment process.

Competitive Advantage: Offering a diverse set of payment options can set you apart from competitors, making your platform the preferred choice for customers seeking convenience and flexibility in their payment methods.

Regulatory Compliance: By integrating local payment methods, you align with local regulations and financial practices, minimizing legal and operational risks associated with international transactions.

Reduced Costs: Local payments can be more cost-effective for both merchants and consumers, avoiding the high fees associated with international card payments and currency conversions.

As the digital economy continues to connect markets worldwide, the strategic incorporation of local payment options into your payment gateway is essential. It not only respects and caters to the preferences of a global customer base but also capitalizes on the unique opportunities presented by the varied financial landscapes across regions. Embrace the diversity of payment preferences to unlock a world of possibilities for your cross-border business.

Embracing local payment methods comes with its costs, a fundamental truth in the realm of international business. To ensure a smooth integration of these payment solutions onto your platform, it's crucial to evaluate the financial implications:

Setup Fees: Assess whether an initial investment is required to access the service.

Platform Fees: Understand the service's cost structure—whether it operates on a flat rate, transaction percentage, or a combination of both.

Payout Options: Consider the currency in which the provider will settle payments to your business account, and whether it aligns with your financial preferences or needs.

FX Rates: Analyze the exchange rates offered for conversions, especially if payouts are in a different currency than your primary business operations.

Gaining a comprehensive understanding of these expenses is key to selecting a payment gateway that aligns with your business objectives and budgetary constraints.

In navigating these costs, Tazapay emerges as a pivotal partner for businesses looking to expand their global footprint. Offering competitive pricing and seamless integration, Tazapay enables access to local payment options in over 80 countries, simplifying the process without the need for establishing local entities. This advantage allows businesses to rapidly adapt to market demands and consumer preferences, ensuring a cost-effective and efficient payment solution tailored to the needs of international commerce.

The landscape of local payment methods is as diverse as the regions they serve. Each area has cultivated solutions that resonate with its unique market dynamics:

This regional overview underscores the importance of choosing payment methods that align with the local consumer behavior and technological infrastructure.

Integrating local payment methods into your cross-border payment strategy is imperative for businesses targeting international markets. By offering payment options that cater to regional preferences, you can enhance customer experience, expand market reach, and improve conversion rates. With the support of partners like Tazapay, navigating the complexities of global payments becomes more manageable, allowing your business to thrive in the competitive landscape of international e-commerce.

Why read this? If you manage revenue, product, or finance, each point below highlights real blockers our customers faced, the cost of staying put, and the measurable upside they unlocked after switching to Tazapay.

You must register subsidiaries and open bank accounts before accepting local methods. This meant 6–12 months of legal work, setup fees, and capital locked in minimum balances. Expansion stalls.

Tazapay Fix: One integration unlocks local payment methods in 80+ countries—no local entities required. Tazapay acts as the Merchant of Record, enabling you to collect like a local. OTAs and SaaS platforms launched in 3 new markets in under 30 days, saving over US$100k in setup costs.

Turning on each new payment rail demands dev sprints, QA, and ongoing maintenance, so product roadmaps slip and tech debt piles up.

Tazapay Fix: A single API or no-code hosted checkout auto‑adds every current and future rail. Teams cut 80% of payment‑related engineering hours after go‑live.

Card disputes and “friendly fraud” drain ops time, inflate reserves, and write off revenue.

Tazapay Fix: Irrevocable local payment methods eliminate chargebacks. For card payments, AI risk engines and 3DS optimization reduce fraud and dispute rates. Merchants recovered 2–3% of topline previously lost to disputes.

Forced currency conversions and opaque spreads quietly erode up to 5% of revenue.

Tazapay Fix: Tazapay reduces unnecessary FX by letting you hold balances in multiple currencies and convert only what you need. You benefit from transparent, competitive FX rates, with up to 80% of conversions avoided.

International card declines of 30–40% lead to abandoned carts and costly re‑acquisition campaigns.

Tazapay Fix: Local payment rails and region-preferred payment options helped global businesses lift success rates to over 85%. Marketplaces saw double‑digit GMV growth within one quarter.

Keeping pace with KYC, AML, and shifting local rules eats legal budgets and risks fines or frozen funds.

Tazapay Fix: Compliance is embedded—Tazapay is MAS-licensed and FINTRAC-registered. With automated KYC, sanctions screening, and localized flows, launches happen 4× faster with no extra compliance headcount. For India, Tazapay also supports FIRC and BOE documentation for regulatory compliance.

Switching gateways can cause downtime, failed callbacks, and angry customers.

Tazapay Fix: A dedicated migration squad runs sandbox shadow tests and parallel processing until everything passes. Clients moved millions with zero service interruption and immediate cost savings.

Managing cross-border collections, holding funds, and making payouts often requires stitching together multiple providers—slowing operations, increasing costs, and fragmenting visibility.

Tazapay Fix: Tazapay unifies the entire payment flow—collect, hold, and payout—into one platform. Accept payments via 80+ local methods, hold balances in 35+ currencies with named virtual accounts, and disburse funds in over 100 currencies globally. Businesses streamline operations, accelerate settlement cycles, and gain full control over their global cash flow.

Share your monthly cross-border volume and top target collection or payout markets, and we’ll map out exact savings and a step‑by‑step migration plan.

.png)

It is a given that all online B2B businesses strive for a seamless checkout experience, crucial for cementing a reputation of impeccable service and reliability. But when it comes to payment solutions, the choice between Payment Links vs Payment APIs often arises. What exactly are these options, and which is best suited to meet your specific business needs? Dive deeper as we explore these online payment integration solutions to determine the best payment API for B2B businesses or if payment links offer the efficiency and security your business requires.

There’s often confusion surrounding the term ‘payment link’ due to varying terminologies used by different payment providers, including phrases like ‘pay by link’ or ‘pay button’. Essentially, payment links are URLs or buttons clicked by users to transfer funds specific to a transaction—typically for purchasing a product or service, distinct from standard options like a “Buy Now” or “Donate” button.

Despite the simplicity of payment links, providers may offer variations:

Payment links seem straightforward to implement and use, but are they the right fit for your online B2B business? Let's explore the advantages and potential drawbacks.

Given their straightforward nature, payment links are particularly advantageous for businesses in the early stages of digital transformation. For instance, freelancers with portfolio sites or businesses that have yet to fully integrate an online checkout system could see significant benefits. Payment links provide a simple yet effective solution for these scenarios.

Moreover, businesses that have not completely digitised their customer interactions or brokers who facilitate transactions between two parties will find payment links invaluable. They are not only easy to implement but also ensure that transactions are completed swiftly and efficiently.

Suitable Business Examples for Payment Links:

The 'API' in 'payment API' stands for Application Programming Interface. Simplified, it acts as the intermediary that allows different software applications to communicate by sending and retrieving data to and from a server. If the software shares a data library, the API can link these systems together, displaying the necessary results to end-users.

APIs generally come in two different variants: hosted and native. An API that is mainly integrated into the website is generally deemed to be ‘native’ whereas one that mostly directs customers to third party services is ‘hosted’.

Much like their counterpart, both forms of Payment APIs possess their pros and cons.

A robust payment API offers diverse configurations to accommodate different levels of integration based on your website’s design, ensuring that whether your online B2B business is small or large, you can tailor the checkout experience to fit your needs.

Payment APIs are particularly beneficial for platforms that require integrated online checkout systems, as these APIs are designed to work seamlessly with such setups. Marketplaces that need flexibility in adjusting fees, such as processing commission deductions in transactions, also find great value in payment APIs. These include:

While setting up payment APIs can seem daunting, understanding how to leverage their capabilities can significantly enhance your operations. The best fit for your online B2B business depends on your unique needs and the complexity of your payment processes.

It's evident that payment links are well-suited for businesses still transitioning to digital platforms or those requiring simple, reliable transaction processes. On the other hand, payment APIs are recommended for businesses with established online checkout systems, marketplaces needing flexible fee adjustments, and SaaS platforms managing recurring payments. These APIs simplify the payment process, ensuring a smooth transactional experience.

Considering an upgrade to your B2B payment solutions? Tazapay offers both hosted and native API solutions tailored to meet your escrow needs. Our APIs are designed for easy integration and transparency in transactions.

Contact us today to explore how our payment solutions can benefit your business

India’s B2B e-commerce market continues to surge ahead in 2025, becoming a hotbed of opportunity for both local and global players. With digital transformation accelerating across all industries, the adoption of modern payment infrastructure is playing a crucial role in shaping India’s business-to-business (B2B) ecosystem.

For businesses planning to expand into India’s booming online B2B space, understanding the evolving payment landscape is essential. In this post, we explore the latest payment trends, preferred methods, regulatory updates, and what to expect when entering this fast-growing market.

A RedSeer report projected back in 2019 that India’s B2B e-commerce market would outpace B2C with an exceptional CAGR of 80%, aiming to hit USD 60 billion by 2025. Fast forward to today, and that forecast has largely held up. India's B2B payments market is now a focal point of innovation and investment, supported by strong internet infrastructure, rising digitization, and favorable government policies.

The payment gateway sector, in parallel, has shown consistent momentum. According to a Business Wire report, India’s payment gateway market was set to register a CAGR of 15% through 2025. This growth has been driven by increased adoption of digital commerce, evolving regulatory frameworks, and the rise of real-time payment rails like UPI.

India's payment behavior in the B2B e-commerce space continues to evolve, driven by convenience, mobile adoption, and growing trust in digital services. Here's how businesses and buyers prefer to transact online in 2025:

Credit and debit cards still hold significant sway, particularly for automated B2B transactions like payroll, reimbursements, and vendor payouts.

Commercial cards are gaining traction among SMEs, despite lingering concerns about high transaction fees.

As of February 2025, HDFC Bank continues to lead India's credit card market with a 22% share, followed by SBI Card at 19%, ICICI Bank at 17%, and Axis Bank at 14%.

Digital wallets have become second nature for Indian users.

Unified Payments Interface (UPI) dominates real-time transfers for both P2P and B2B payments. Its seamless interoperability and previously zero-MDR policy (now re-evaluated) helped skyrocket usage.

UPI 2.0, UPI Lite, and Credit on UPI features are making it even more relevant for B2B transactions.

As of April 2025, UPI processes over 13.2 billion transactions per month.

While not the top choice for B2B e-commerce, bank transfers remain relevant for large-value or bulk transactions.

Traditional NEFT, RTGS, and IMPS services are now integrated into digital platforms to ensure faster settlement and reduce paperwork.

UPI has become the foundation for digital commerce in India. With innovations like UPI AutoPay, UPI Lite, and Credit on UPI, it now supports recurring billing and even offline-first transactions—making it more adaptable to B2B needs.

Global operators like Visa and Mastercard are actively localizing their services.

Soft POS (tap-to-phone) features allow merchants and MSMEs to accept card payments using NFC smartphones—without costly hardware.

Example: Mastercard’s collaboration with Axis Bank and Worldline to roll out contactless payment acceptance for MSMEs.

The Reserve Bank of India (RBI) continues its push for secure, compliant digital payments (Source).

Key updates include:

If you’re building or scaling a B2B e-commerce platform in India, here are a few essentials:

Tazapay is a trusted international payment provider for businesses operating in India and across borders. Here's how we simplify B2B payments:

Whether you're a SaaS company billing global clients, a cross-border marketplace collecting in India, or an enterprise scaling internationally—Tazapay helps you move money faster, safer, and smarter.

India’s B2B payments landscape in 2025 is more digitized, efficient, and innovation-driven than ever before. From real-time UPI adoption and commercial card enablement to regulatory clarity and mobile-first infrastructure—the momentum is clear.

For international businesses eyeing India, the opportunity is massive—but success depends on aligning with the right infrastructure and payment partner.

Tazapay makes that journey seamless, secure, and scalable—so you can focus on growth, not compliance.

Singapore, 27 August 2025 – Tazapay, a leading global cross-border payments infrastructure platform, has successfully closed its Series B funding round with investments from Peak XV Partners, Ripple (US), Circle Ventures, Norinchukin Capital (Japan), and GMO VenturePartners (Japan). Existing investors including January Capital, ARC180, and RTP Global also participated in this round.

This milestone comes as Tazapay continues its rapid growth, now processing more than $10 billion in annualized payment volume with a 300% year-over-year increase and achieving operational breakeven.

With its differentiated platform, Tazapay empowers global businesses with seamless local collection and payout capabilities across 70+ markets. Its infrastructure spans alternative payment methods, cards, virtual bank accounts, payouts, and stablecoins—backed by institutional-grade security and compliance across multiple jurisdictions.

The strategic participation of Ripple and Circle—two global leaders in blockchain-based and stablecoin-powered payments—underscores Tazapay’s role as the fiat network bridging traditional finance with stablecoins in emerging markets, strengthening last-mile connectivity for global businesses.

The new funding will also accelerate Tazapay’s licensing roadmap, with applications already underway in the UAE, US, Hong Kong, Australia, and for a Digital Payment Token (DPT) license in Singapore.

In parallel, partnerships with GMO VenturePartners and Norinchukin Capital will further expand Tazapay’s footprint in Japan, where it will enable local payment methods and support Japanese enterprises in scaling internationally.

Speaking on the announcement, Rahul Shinghal, Co-founder and CEO of Tazapay, said:

“We’re entering the next chapter of our journey—one where modern payment technologies, regulatory compliance, and partnerships with global leaders will enable the future of cross-border commerce. This funding is not just capital—it’s fuel for our long-term vision of building a truly global collection and payout infrastructure on modern rails.”

Tazapay’s Series B marks a pivotal step in shaping the future of cross-border commerce, bridging the gap between traditional banking and next-generation, borderless digital finance.

Read more here.

CB Insights today named Tazapay to its sixth-annual Fintech 100 ranking (previously the Fintech 250) - showcasing the 100 most promising private fintech companies of 2023.

"Representing 24 different countries across the globe, this year's Fintech 100 is shaping the future of real-time payments, spend management automation, embedded finance, and more," said Chris Bendtsen, Lead Fintech Analyst, CB Insights. Together, they are not only increasing the pace of innovation, but launching new products and features to revolutionize the industry as a whole. I cannot wait to see what this cohort accomplishes next."

"Being recognized in the CB Insights' Fintech 100 list is an affirmation of our vision to revolutionize cross-border payments. We're committed to creating solutions that not only simplify transactions but also instill trust in global commerce. This acknowledgement fuels our determination to push boundaries further," remarked Rahul Shinghal, CEO of Tazapay

Utilizing the CB Insights platform, the research team selected these 100 winners from a pool of over 19,000 private companies, including applicants and nominees. They were chosen based on factors including - equity funding, investor profiles, business relationships, R&D activity, news sentiment analysis, competitive landscape, proprietary Mosaic scores, and Yardstiq transcripts - and criteria such as tech novelty and market potential. The research team also reviewed thousands of Analyst Briefings submitted by applicants.

In a rapidly globalizing e-commerce landscape, Tazapay emerges as a crucial enabler. Its platform provides seamless and secure payment solutions, empowering businesses to confidently operate on a global scale. Tazapay has bridged the gap for cross-border merchants and enterprises, facilitating payment collections from 173+ global markets. Furthermore, the introduction of local payment options such as local bank transfers, QR codes, e-wallets, vouchers, etc. enables businesses to tap into diverse customer segments within these markets, further widening and deepening their reach. Demonstrating commitment to growth and compliance, Tazapay secured a license from the Monetary Authority of Singapore (MAS) and successfully closed its Series A funding in 2023

Quick facts on the 2023 Fintech 100:

About CB Insights

CB Insights builds software that enables the world's best companies to discover, understand, and make technology decisions with confidence. By marrying data, expert insights, and work management tools, clients manage their end-to-end technology decision-making process on CB Insights. To learn more, please visit www.cbinsights.com.

About Tazapay

Tazapay is reshaping the cross-border e-commerce landscape by offering secure, transparent, and efficient payment solutions tailored for global commerce. Catering to industries such as travel, gaming, ed-tech, SaaS, and e-commerce, we're committed to fostering trust and facilitating smooth global transactions. As the e-commerce domain continues to expand, Tazapay remains dedicated to being the payment solution partner of choice for businesses around the globe. Learn more at www.tazapay.com

SINGAPORE, August 2, 2023 /PRNewswire/ - Following the in-principle approval earlier this year, Tazapay Pte. Ltd. (“Tazapay”) a leading fintech company specialising in cross-border payments, is delighted to announce the attainment of a Major Payment Institution (MPI) licence from the Monetary Authority of Singapore (MAS). The approval from MAS further underpins Tazapay's commitment to robust regulatory compliance and operational excellence.

Singapore, known as a hub for international trade and commerce, offers the perfect vantage point for Tazapay to expand its reach and impact across Asia and beyond. The MPI licence allows Tazapay to extend its full suite of services, spanning account issuance, merchant acquisition, cross-border and domestic money transfers, and e-money issuance, to its growing client base.

Rahul Shinghal, CEO of Tazapay, shares his excitement, "Receiving this licence from MAS is a remarkable milestone in our journey. It not only signifies our commitment to delivering the highest standards of regulatory compliance but also paves the way for us to provide even more innovative and mission-critical cross-border payment solutions. As a Singapore-born and headquartered company, we view this achievement with immense pride and gratitude."

Even amidst a challenging tech winter, Tazapay continues to demonstrate resilience and an unwavering commitment to growth. The MPI licence acts as a catalyst for a host of forthcoming initiatives dedicated to augmenting the quality, security and user-friendliness of Tazapay's services. Coupled with the successful closing of our series A funding of USD 16.9 Million, Tazapay is better positioned than ever to transform the way cross-border e-commerce merchants operate especially in sectors such as travel, education technology, fashion & apparel, gifting and gaming.

With this milestone, Tazapay is ready to redefine cross-border transactions, offering a seamless and secure payment experience to businesses in the vibrant e-commerce space. The journey continues, and Tazapay remains dedicated to its mission of making global payments as smooth and frictionless as possible.

Tazapay is a Singapore-based fintech company, designed to redefine the cross-border payment experience. Since its inception in 2021 by industry veterans, Tazapay has raised a successful $16.9 million Series A funding round, with significant investment from prestigious institutions such as Sequoia and the PayPal Alumni Fund. The platform allows businesses to transact with ease in 173+ countries, offering an array of card and local payment options. Its unified interface simplifies the onboarding process, allowing businesses to partner with just one entity, thereby streamlining their payment process. Tazapay continues to drive global business growth by offering a trusted and accessible platform for cross-border e-commerce transactions.