Thailand is one of Southeast Asia’s fastest-growing digital economies. With a population that is increasingly mobile-first, digital payments are now part of everyday life. For international businesses selling to Thai customers, however, the biggest challenge remains checkout success.

Credit and debit cards remain important, but they often fall short. Many transactions are declined, card coverage is limited outside urban centers, and foreign exchange costs can discourage buyers. This results in abandoned checkouts and lost revenue opportunities.

PromptPay, Thailand’s national QR-based payment method overseen by the Bank of Thailand and National ITMX, has become the mainstream alternative. With more than 81 million registrations and billions of transactions every month, it is trusted by consumers across all sectors.

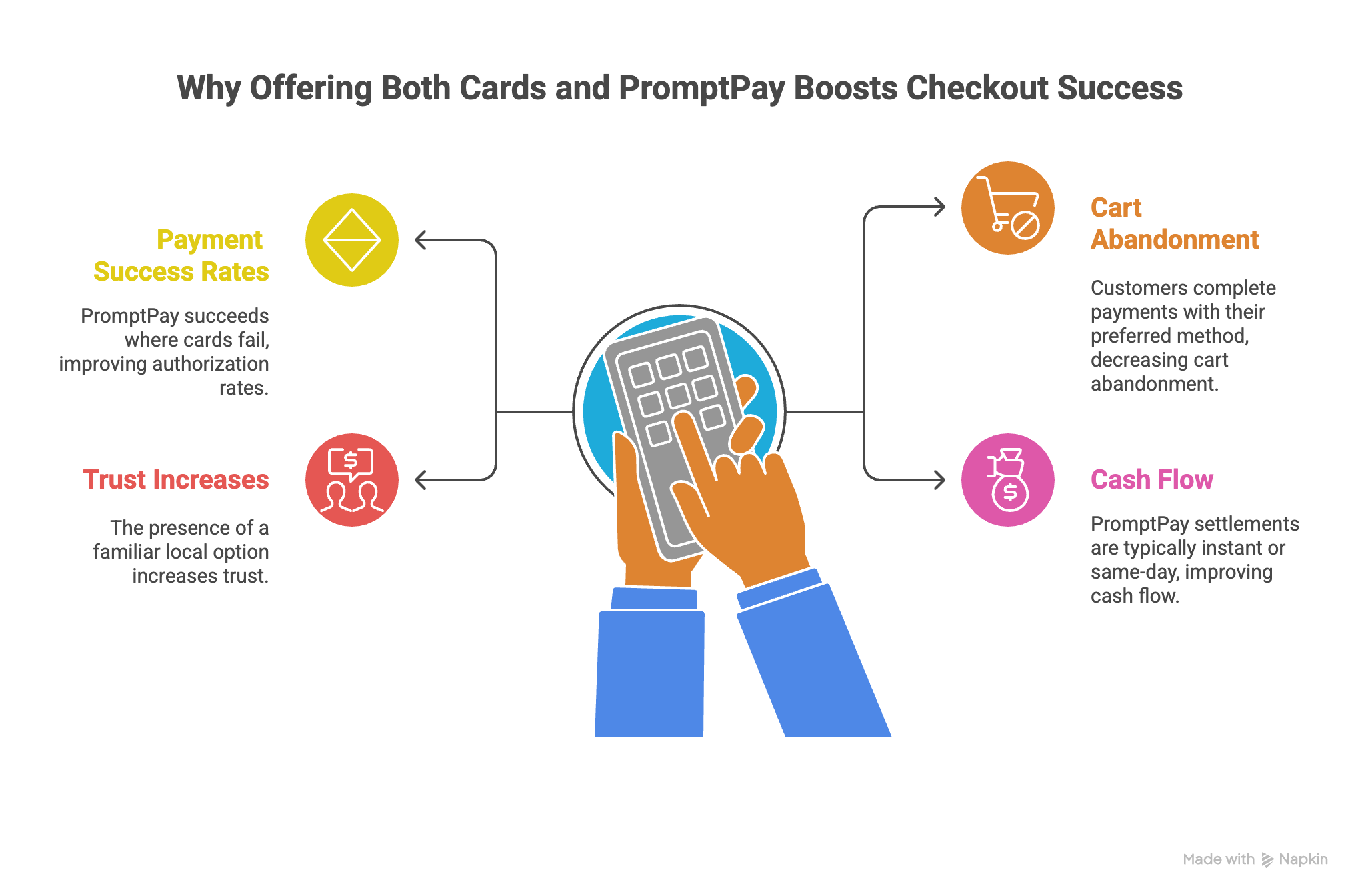

For global B2B and e-commerce businesses, enabling PromptPay alongside cards means fewer failed payments, higher authorization rates, and greater customer trust.

With Tazapay, you can offer PromptPay through a unified checkout that also supports cards and 80+ other local payment methods, going live within days.

PromptPay adoption has grown dramatically, making it an indispensable part of Thailand’s payment ecosystem:

This progression shows PromptPay’s journey from a domestic initiative to a critical tool for international businesses. Offering PromptPay at checkout has become an expectation, not a differentiator, for global merchants operating in Thailand.

.png)

E-commerce platforms and online marketplaces often see high cart abandonment in Thailand due to card failures or customer hesitation.

By offering PromptPay alongside cards:

PromptPay has become a default option for Thai shoppers, so businesses that include it maximize completed orders and revenue.

Thailand’s travel industry is huge, and online booking platforms often face failed transactions at checkout. This is particularly challenging for mid-range purchases like hotel reservations or tour bookings.

PromptPay helps by:

For online travel agencies and hotel platforms, PromptPay improves booking completion and reduces drop-offs.

Thailand has one of Asia’s most engaged digital populations, with significant spending on gaming and online products. But micro-transactions and one-off purchases often fail on card-only checkouts.

PromptPay ensures:

This makes PromptPay especially valuable for digital platforms, app stores, and gaming companies serving Thai customers.

As online education grows in Thailand, payment access remains a barrier. Many students and professionals lack international-ready cards, making it difficult to enroll in global courses.

PromptPay solves this by:

Businesses that provide multiple payment options serve more customers and reduce payment risk. In Thailand:

PromptPay complements cards rather than replacing them. Together, they capture the widest possible customer base and maximize checkout success.

Merchants relying only on cards or international transfers face:

Adding PromptPay addresses these risks and future-proofs your checkout strategy.

Tazapay simplifies the complexity of enabling PromptPay for cross-border businesses:

Whether you prioritize speed or brand control, Tazapay gives you the flexibility to add PromptPay and optimize checkout for higher authorization rates and faster settlement.

Thailand’s digital economy offers huge opportunities for global businesses, but only if they solve checkout friction. Cards remain necessary, but PromptPay has become an equally important option.

With more than 81 million registrations and over 2 billion monthly transactions in 2025, PromptPay is one of Thailand’s most trusted and widely used payment methods. Businesses that offer it alongside cards increase conversions, reduce abandonment, and build stronger customer trust.

With Tazapay, you can integrate PromptPay quickly and compliantly, enabling a better checkout experience for your Thai customers.

Ready to start? Talk to Tazapay and enable PromptPay today.

South Korea is a global leader in digital commerce, boasting one of the highest internet penetration rates and mobile adoption rates in the world.

However, succeeding in this digitally advanced economy demands more than just offering international card acceptance — it requires local adaptation, especially when it comes to payments.

Unlike Western markets where Visa, Mastercard, and PayPal dominate, Korean consumers strongly prefer domestic payment options.

More than 70% of online transactions in South Korea are processed through local digital wallets such as NaverPay, KakaoPay, and SamsungPay.

Recognizing this need for localization, Tazapay now enables merchants to offer Korea’s most trusted local payment methods — making entry into the Korean market simpler, faster, and operationally efficient.

International merchants can now accept payments through:

Through a single integration with Tazapay, businesses can offer these payment methods without needing to establish a local entity, open domestic bank accounts, or sign separate acquiring contracts.

South Korean consumers expect — and often require — familiar domestic payment methods at checkout.

Failure to offer recognizable options results in:

Conversely, merchants who localize their checkout experience by offering domestic wallets and local cards see:

The message is clear: adapting to local payment preferences isn't just operationally smart — it's commercially critical.

Tazapay’s platform architecture is built to remove traditional barriers to global expansion.

Through Tazapay, merchants can:

This Collect-Hold-Pay capability — unified under one platform — allows merchants to manage incoming funds and outgoing disbursements without multiple vendor relationships, reconciliations, or compliance overhead.

Simpler Onboarding:

Checkout Localization:

Optimized FX Management:

Improved Cash Flow:

Reduced Compliance Risk:

Operational Simplicity:

By centralizing these capabilities, merchants save on setup costs, legal complexity, and operational drag — accelerating their ability to capture market share in Korea.

South Korea continues to be a high-growth, digitally sophisticated market.

Mobile payments, domestic digital wallets, and local payment rails are the standard — not the exception — for Korean consumers.

International merchants who localize their payment strategies now will be better positioned to:

With Tazapay’s latest launch, expanding into South Korea has never been simpler.

One platform. One contract. Full access to Korea’s preferred payment options — without local entity setup or operational complexity.

👉 Start collecting Korean local payments today with Tazapay.

Local payment methods and e-wallets dominate Southeast Asia’s digital economy, far outpacing credit card adoption. Consumers across the region rely on QR payments, bank transfers, and mobile wallets for everyday transactions due to their convenience, security, and accessibility. For businesses, accepting these preferred payment options is crucial for expanding reach and driving growth. This guide breaks down the most widely used local payment methods in Singapore, Thailand, Indonesia, Malaysia, Vietnam, and the Philippines, offering insights into how they shape the region’s fast-evolving payment landscape.

1. PayNow

PayNow is Singapore’s real-time bank transfer system that allows users to send money instantly using mobile numbers or UENs (Unique Entity Numbers). Widely adopted for both personal and business transactions, it has become a cornerstone of Singapore's cashless society. Users appreciate its simplicity—by linking their bank accounts to their mobile numbers and scanning an SGQR (a unified QR code) completes transactions instantly without additional fees. For international businesses, integrating PayNow can streamline transactions with Singaporean consumers and partners, facilitating smoother financial operations.

2. GrabPay

Integrated within the Grab super-app, GrabPay offers services ranging from ride-hailing to food delivery and in-store purchases. Its widespread acceptance and user-friendly interface have made it a popular choice among Singaporeans. Users can easily top up their GrabPay wallets and make payments by scanning QR codes, ensuring swift transactions. International businesses can tap into GrabPay's extensive user base by offering it as a payment option, thereby enhancing customer reach and satisfaction.

3.DBS PayLah!

DBS PayLah! is a mobile wallet service by DBS Bank, one of Singapore's leading financial institutions. It enables users to perform a variety of transactions, from bill payments to peer-to-peer transfers. The app's integration with Singapore's national QR code standard (SGQR) ensures compatibility with numerous merchants, enhancing its utility. For businesses, integrating DBS PayLah! can provide access to a broad customer base, particularly those who prefer using bank-affiliated payment solutions.

4. FavePay

FavePay is a mobile payment app that rewards users with instant cashback at participating merchants. Popular among deal-seekers in Singapore, it enhances the shopping experience with its rewards program. Users can make payments by scanning QR codes and enjoy immediate discounts, fostering customer loyalty. Businesses can benefit from increased patronage by partnering with FavePay and participating in its promotional campaigns.

1. PromptPay

PromptPay is Thailand's government-backed real-time payment system that links mobile numbers or national ID numbers to bank accounts, facilitating instant transfers. Widely used for both personal and business transactions, it supports e-commerce payments and utility bill settlements. Its interoperability with Singapore’s PayNow for cross-border transfers enhances its utility for international transactions. For businesses, integrating PromptPay can simplify payment processes and help reduce transaction costs.

2. ShopeePay

Integrated with Southeast Asia’s top e-commerce platform, ShopeePay enables QR payments for online and offline shopping. Recently, it became a payment option for Apple services in Thailand, enhancing its utility beyond e-commerce. ShopeePay’s widespread acceptance at partner merchants makes it a preferred choice for consumers and businesses seeking convenience.

3. WeChat Pay

WeChat Pay is popular among Chinese tourists in Thailand but has also gained traction among local users due to its seamless QR-based payment system at major retailers and restaurants. It facilitates cross-border payments in multiple currencies, making it ideal for international travelers. Businesses catering to tourists can benefit from accepting WeChat Pay, enhancing the payment experience for foreign customers.

4. TrueMoney Wallet

With 16.8% market share, TrueMoney offers low fees (acceptance fee of only 1% of the transaction value, compared to costlier cards transaction fees) and supports utility bills, gaming, and cross-border remittances to Cambodia and Myanmar. Its versatility makes it a staple for both personal and business transactions. For businesses, integrating TrueMoney Wallet can attract cost-conscious consumers seeking affordable payment options other than cards.

5. Rabbit LINE Pay

A collaboration between Rabbit, the BTS Skytrain's payment system, and LINE, a popular messaging app, Rabbit LINE Pay offers a seamless payment experience. Users can pay for public transportation, shop online, and make in-store purchases using the service. The integration with LINE's platform allows for peer-to-peer transfers and bill splitting among friends. Its rewards program incentivizes usage through points and cashback offers. The service's user-friendly interface and widespread merchant acceptance have contributed to its rapid growth.

1. QRIS (Quick Response Indonesian Standard)

QRIS is Indonesia’s unified QR code system that integrates multiple banks and e-wallets under one standard. It simplifies cashless transactions for consumers by allowing them to use their preferred wallet or banking app at any QRIS-enabled merchant. For businesses, QRIS reduces operational complexity by eliminating the need for multiple QR codes. Merchants benefit from its interoperability across 22.4 million merchants nationwide, while consumers enjoy seamless payments for everything from groceries to transportation.

2. OVO

OVO is a versatile e-wallet widely used for ride-hailing services (Grab), bill payments, and retail transactions. Its cashback rewards program attracts younger demographics, while merchants benefit from its extensive integration across platforms.

3. DOKU

Doku Wallet is a pioneer in Indonesia’s digital payments space, offering virtual accounts for online transactions. It caters to both consumers and merchants by providing flexible payment options like ATM transfers and mobile banking, making it ideal for e-commerce businesses targeting customers who prefer traditional banking methods.

4. LinkAja

LinkAja focuses on essential services like transportation tolls, utilities, and retail shopping while aligning with the national QRIS standard for interoperability. Businesses targeting middle-income consumers find LinkAja particularly useful due to its government backing.

5. Dana

Dana is a secure e-wallet offering features like bill payments, fund transfers, and QR code scanning for transactions. Its user-friendly interface makes it popular among consumers seeking convenience in day-to-day payments.

6. GoPay

Originating from Gojek, Indonesia's multi-service platform, GoPay has become one of the country's leading digital wallets. Users can pay for services like transportation, food delivery, and online shopping. The wallet's integration with Gojek's ecosystem offers users a seamless payment experience. GoPay's peer-to-peer transfer feature allows users to send money to friends and family effortlessly. Its partnership with various financial institutions has expanded its services to include insurance and investment products.

1. FPX (Financial Process Exchange)

FPX is Malaysia's national real-time retail payments platform, facilitating secure online bank transfers. It's widely used for high-value transactions and is favored by both consumers and businesses due to its reliability and low fees. FPX's integration with major e-commerce platforms and its oversight by Bank Negara Malaysia make it a trusted payment method for online purchases, bill payments, and fund transfers.

2. Touch 'n Go eWallet:

Initially developed for toll payments on Malaysia's highways, Touch 'n Go eWallet has evolved into a versatile digital payment solution that caters to a wide range of consumer needs. It now supports retail shopping, bill payments, and even cross-border QR transactions in Singapore. The platform integrates seamlessly with merchants, allowing businesses to accept payments via QR codes and streamline checkout processes. Consumers benefit from its user-friendly interface, cashback rewards, and promotions, which incentivize frequent usage. Its ability to handle both online and offline transactions makes it ideal for everyday expenses, from groceries to entertainment.

3. Boost:

Boost is a gamified digital payment platform that has rapidly gained popularity among younger Malaysians. It offers cashback rewards, digital vouchers, and exclusive promotions for transactions across various sectors such as retail shopping, bill payments, and food delivery. Boost’s unique “Shake” feature adds an element of fun by allowing users to earn instant rewards after every transaction. The platform is particularly appealing to small businesses and micro-entrepreneurs due to its low-cost setup and ability to attract tech-savvy customers.

4. MAE by Maybank:

MAE (Maybank Anytime Everyone) is an innovative lifestyle app offered by Maybank that combines traditional banking services with modern financial tools. Beyond its function as a digital wallet for payments and transfers, MAE includes features like budgeting tools, savings goals, expense tracking, and even a virtual debit card for online shopping. These features make MAE particularly appealing to consumers who want greater control over their finances while enjoying the convenience of cashless payments. For businesses, MAE provides seamless integration with Maybank’s merchant services, enabling them to accept payments from one of Malaysia’s largest banking customer bases.

1. Momo Wallet

Momo leads Vietnam's e-wallet market with over 31 million users. It offers a comprehensive suite of services including bill payments, money transfers, and even investment options. Momo's popularity stems from its user-friendly interface and extensive merchant network. For businesses, integrating with Momo provides access to a large, engaged user base and can significantly boost sales, especially in sectors like food delivery and e-commerce.

2. VNPT EPAY

VNPT EPAY, backed by Vietnam's telecom giant VNPT Group, operates an extensive network of over 2,100 transaction points nationwide. It specializes in utility bill payments, mobile top-ups, and retail transactions. VNPT EPAY's wide reach makes it particularly valuable for businesses targeting consumers in both urban and rural areas. The platform's integration with various service providers simplifies bill payments for millions of Vietnamese households.

3. ZaloPay

ZaloPay leverages its integration with Zalo, Vietnam's most popular messaging app, to provide seamless payment services. Users can easily send money, pay bills, and make purchases without leaving the Zalo ecosystem. This integration makes ZaloPay particularly attractive for social commerce and peer-to-peer transactions. Businesses can benefit from ZaloPay's social features to enhance customer engagement and drive sales.

1. QR Ph

QR Ph is the Philippines' national QR code standard, designed to promote interoperability among various payment service providers. It allows users to make payments using any participating e-wallet or banking app by scanning a single QR code. For businesses, adopting QR Ph simplifies payment acceptance and reduces the need for multiple QR codes at the point of sale. This standardization is expected to accelerate the adoption of cashless payments across the country.

2.GrabPay

GrabPay has become integral to the Philippines' digital payment landscape, offering a seamless experience for Grab's ride-hailing and food delivery services. It has expanded to include bill payments, online shopping, and even investments. GrabPay's loyalty program, which offers points for every transaction, has been a key driver of user adoption. For merchants, GrabPay provides access to Grab's large user base and detailed analytics to help optimize their businesses.

3.ShopeePay

ShopeePay has leveraged Shopee's e-commerce dominance to become a major player in the Philippines' digital payment space. It offers cashback rewards, discounts, and seamless checkout experiences on the Shopee platform. ShopeePay has also expanded to offline merchants, particularly in partnership with convenience stores like 7-Eleven. This omnichannel approach makes ShopeePay an attractive option for businesses looking to reach customers both online and offline.

4.Maya (formerly PayMaya)

Maya has evolved from a simple e-wallet into a comprehensive financial services platform. It offers features like a savings account, cryptocurrency trading, and micro-investments alongside traditional payment services. Maya's all-in-one approach appeals to tech-savvy Filipinos looking for a unified financial solution. For businesses, Maya provides robust payment APIs and plugins for easy integration into various e-commerce platforms.

Southeast Asia's diverse and rapidly evolving payment landscape presents both opportunities and challenges for businesses. Understanding and integrating local payment methods is crucial for success. As this guide has highlighted, each country boasts a unique blend of digital wallets, real-time payment systems, and traditional methods, all shaping consumer preferences and business operations.

By partnering with Tazapay, businesses gain a significant advantage in navigating this complex landscape. Tazapay's localized payment rails enable you to offer popular methods like PayNow, FPX, and QRIS without needing local entities, streamlining cross-border transactions and reducing operational overhead. With multi-currency support, high conversion rates, and advanced fraud management, Tazapay empowers businesses to tap into Southeast Asia's growing digital economy with confidence.

Thailand is embracing the dawn of digital payments after being cash-dependent for decades. In the last six years, the nation has made significant strides in rolling out financial technology, increasing the penetration of such services among its populace¹. According to 2022 statistics, approximately 77.8% of Thailand's population of 70.01 million are active internet users, showcasing a high degree of digital literacy².

A key driver in Thailand's digital transformation has been PromptPay, an interbank real-time payment system, developed as part of the National e-Payment Master Plan¹. PromptPay is not only a popular local payment method but is increasingly integrated into international payment gateways, facilitating cross-border transactions.

PromptPay is a cornerstone of Thailand's payment systems, operating as an interbank real-time, near-instant payment gateway that simplifies the way users receive and transfer funds. It links payments to a Citizen ID or mobile phone number, and is similar in functionality to India’s UPI and Singapore’s PayNow3.

Developed in cooperation with major Thai banks and Vocalink, a Mastercard company, PromptPay is instrumental in supporting the Thai government’s initiative to transition from a cash-reliant economy to a robust digital economy4.

Thailand led all countries in real-time payment transactions per capita in 2022, with the payment method accounting for 34% of all transactions5. The significant uptake of PromptPay is attributed to the widespread availability of mobile phones, which have been a major driver of digital adoption and PromptPay transactions. Since its implementation in 2017 to 2023, PromptPay transactions have surged annually from 88.07 million to over 19.9 billion, underscoring its central role in Thailand's digital economy and cross-border transactions6.

Despite these encouraging numbers, the real sentiment towards digital payments in Thailand remains complex. During the pandemic, digital payment methods saw a surge in use, but in 2022, a survey by the Bank of Thailand indicates a revert to cash for many7. Citing convenience and the absence of added fees, over 50% of respondents across all age groups expressed a preference for cash, with only 27% of the surveyed continuing with digital payment apps post-pandemic8.

As read in the previous section, Promptpay might not be the ultimate solution for digital payments. Nonetheless, it continues to grow in popularity as a local payment method in Thailand and as part of international payment gateways. Why is this so? We now explore its key advantages and limitations:

PromptPay is primarily a local payment system in Thailand, but the Thai government is expanding its reach internationally, with agreements already in place with Malaysia and Singapore. For cross-border transactions, PromptPay requires the use of a third-party payment provider, which serves as the international payment gateway.

1. Users first transfer funds to the payment provider's Thai bank account via PromptPay. This can be done by either scanning a QR code or entering the recipient's Citizen ID or phone number within the PromptPay app.

2. After the transaction, the PromptPay app confirms the successful transfer of funds with a notification.

3. The funds are then transferred to one of the payment provider’s international accounts. Finally, these funds are disbursed to the foreign seller's bank account.

When selecting a third-party payment provider for international transactions involving PromptPay, it’s crucial to choose one that offers a robust network of localised markets. This ensures that the service aligns with the specific needs and regulations of the target markets, enhancing the efficiency of cross-border payments.

As of 2024, PromptPay’s fee structure of local transactions within Thailand are as follows:

This fee model makes PromptPay an attractive option for everyday payments and small business transactions within the country.

When it comes to cross-border payments facilitated through a third-party payment provider, standard charges apply. These include FX costs, platform fees, and setup fees, which vary depending on the provider chosen. For more information, read our blog article on The Actual Costs in Using a Payment Gateway.

Selecting a reputable and secure international payment gateway is thus crucial to manage these costs effectively and ensure transaction security.

Understanding the nuances of PromptPay and its fee structure arms you with the knowledge to more effectively penetrate the Thai market. If you're exploring further solutions to enhance your business operations, consider Tazapay. Offering specialised payment solutions for a wide range of needs—from eCommerce platforms to exporters and importers—Tazapay tailors services to help your business thrive in international markets.

Contact us to find out more

Sources

.png)

As the eCommerce market expands, so does the array of payment gateways available to merchants worldwide. Many are tempted by platforms advertising free or low-cost services, thinking they've secured a great deal. However, the reality of hidden costs of payment gateways often emerges only after transactions begin, potentially eroding profit margins.

Are you grappling with the complexities of global transactions? Consider Tazapay, your global payment gateway partner. With a network extending across 173 countries and a suite of fully digitised solutions for marketplaces and platforms, Tazapay helps you make the world your market.

To better understand this landscape, let’s explore the common costs and fees associated with payment gateways, particularly those involved in cross-border payments.

Platform fees are relatively straightforward—they represent the costs of using a payment platform. Most reputable payment gateways impose some type of fee. These fees can vary, typically appearing as a combination of a flat fee plus a percentage of the transaction, or as a simple percentage-based fee.

For example, some payment gateways may charge fees such as $0.30 plus 2.9% per transaction, or $0.11 plus 3.95%, depending on the payment method. In contrast, Tazapay offers a more streamlined approach, charging either 1.8% or 3% for non-card transactions. To illustrate the differences in cost structures, consider the expense of a $50 transaction versus a $1000 transaction:

Using a $0.30 + 2.9% fee structure, a $50 transaction incurs a cost of $1.75, while a $1000 transaction costs $29.50.

However with Tazapay’s fee, starting from 0.8%, the same transactions would cost just $0.40 and $8, respectively.

Comparing these fee structures highlights significant differences. Opting for a straightforward percentage fee, such as Tazapay’s, can be more cost-effective, particularly for larger transactions where flat fees add up. This comparison underscores the importance of understanding payment gateway fees and how they impact your costs, especially in a cross-border payment gateway context.

Understanding payment gateway costs is essential when considering the financial implications of various payment methods. These platforms may absorb fees, integrating them into overall platform fees, or pass them directly to consumers.

Bank transaction fees play a significant role in the costs associated with direct bank payment methods like local bank transfers and bank redirects. Typically, local bank transfers might incur a surcharge for cross-bank transactions, while in-bank transfers often avoid these fees. Bank redirects, similar in operation to local bank transfers, usually carry minimal processing fees, influenced by national e-commerce policies.

For example, Singapore's PayNow service was free of transaction fees from its launch in July 2017 until January 2021, under a full subsidy. However, a nominal fee of SGD0.22 was introduced in 2022 to cover gateway pricing models adjustments.1

Credit card processing fees are another critical aspect of payment gateway costs. Merchants may apply a surcharge for transactions using card networks like Mastercard or Visa. For instance, as of 2024, credit card processing fees for merchants range from 1.3% to 3.5%, depending on the card and transaction type.2

The cost of wire transfers, particularly for international payments, is a notable part of gateway costs. Domestic wire transfers generally incur lower fees and are processed faster compared to international transfers, highlighting the variability of bank surcharges across different institutions.3

When transactions span multiple geographic regions involving different currencies, international transaction fees and currency exchange costs, or FX costs, are inevitable. Payment gateways often manage these costs by adding a percentage-based fee over the market’s FX rate, or by setting their own buy and sell rates.

This adjustment allows payment gateways to cover the risks and operations involved in currency conversion, forming a significant portion of the payment gateway costs. Understanding these fees is crucial for businesses operating internationally, as they can impact the total cost of transactions significantly.

Setup fees are a common initial cost associated with various online payment methods, including payment links and payment APIs. These fees often reflect the technical expertise required for integration and the complexity of the setup, especially in sophisticated online marketplaces and platforms.

In Malaysia, the variability in gateway setup fees is evident, with the top ten online payment methods charging anywhere from zero to RM300 per year.4 This range illustrates the diverse pricing models that payment gateways employ based on the services and technology they provide.

.png)

With a clear understanding of the various payment gateway costs, including transaction fees, setup fees, and FX costs, you are now equipped to make more informed decisions when selecting a payment gateway that offers the best value for your money.

As you consider your options, take a look at Tazapay. Tazapay offers competitive platform fees at just 0.8 - 2.5% for non-card payments and 3.8% + $0.50 for card transactions. Moreover, it provides some of the lowest FX rates in the market and even promises to match any better rates you might find. Making the right choice for your payment gateway could mean the difference in creating significant savings and efficiency for your business operations.

Sources

1 2020 E-commerce Payments Trends Report: Singapore Country Insights (jpmorgan.com)

2 Average Credit Card Processing Fees (fool.com)

3 Wire Transfer Definition (investopedia.com)

4 Top 10 Online Payment Methods in Malaysia for Ecommerce - ZCOM MY Blog

Europe is one of the largest E-Commerce markets in the world, with revenue projected to reach USD$632.70B in 2024 and a projected market volume of US$977.40bn by 2029 according to predicted annual growth rates.1 This region boasts dynamic digital markets, including Germany, which ranks as the 7th largest globally after China, US and UK.2 This impressive growth is driven by the flourishing digital economies, creating an environment ripe for robust digital payment infrastructures to prosper.

Local Payment Methods in Europe play a crucial role in this growth, and one of the standout systems is Sofort, a pan-European payment service provider. Sofort is integrated into international payment gateways, facilitating cross-border payments and supporting e-commerce businesses. By leveraging online payment solutions like Sofort, merchants can offer user-friendly payment options that cater to the diverse needs of European consumers, enhancing payment security and boosting online transactions.

Sofort is a payment service provider based in Germany that enables users to make payments using their own online banking details, with transactions processed in real-time.3 Operating in over 13 European countries, Sofort's extensive reach is powered by Klarna Kosma’s open banking PISP-based infrastructure.4 This infrastructure allows Sofort to facilitate seamless online transactions and secure online payments across different banks, making it a key player in the European payment methods landscape.

The payment process with Sofort is similar to that of Trustly, as it involves direct banking facilitated via PISPs. This method allows users from various banks to make payments effortlessly, supporting the growing need for alternative payment methods and user-friendly payment options in the region. By integrating Sofort into international payment gateways, businesses can enhance their cross-border payments capabilities and offer reliable online payment solutions to their customers.

The 2023 European E-commerce Report reveals that 78% of all European internet users have purchased goods and/or services this year, with the overwhelming majority of those users coming from Western Europe.5 This indicates a strong preference for local payment methods in Europe, such as Sofort, among consumers.

B2B e-commerce constitutes a significant portion of the European e-commerce market, holding a market share of approximately 63.1%. While B2B dominates, B2C e-commerce has also seen substantial growth, particularly during the pandemic, when over 87% of internet users in the region were e-shoppers in 2020. Although this number has slightly dipped to 85% this year, it still represents a robust market for online payment solutions.6 This trend underscores the importance of payment service providers like Sofort, which cater to the evolving needs of European consumers by facilitating secure online payments and enhancing online transactions.

The steady demand for user-friendly payment options and the growing preference for alternative payment methods suggest a positive outlook for Sofort’s business prospects in the region.

While many strides in technological improvement have led to significant advancements in the online payment gateway market, none are perfect. It is crucial to consider their benefits and drawbacks before making a decision. Here are the pros and cons of using Sofort:

Sofort, being a pan-European payment gateway, is already an international payment gateway in some respects. It is supported in 12 countries: Austria, Belgium, Finland, France, Germany, Italy, Norway, Poland, Spain, Switzerland, The Netherlands, and the United Kingdom. This extensive connectivity enables cross-border payments and integration within international payment gateways across these major European markets.

However, this list, while comprehensive for the larger markets in each quadrant of the EU, does not cover all EU countries, nor does it include markets outside the EU. This limitation means that for transactions made outside Sofort’s supported countries, a third-party payment service provider is required as the international payment gateway to facilitate them.

This understanding of how Sofort fits within international payment gateways is crucial to optimise cross-border payments and cater to a diverse European customer base.

How Sofort Payments Work

Sofort payments normally involve the user accessing their bank account directly via Sofort and inputting their PIN and TAN to complete the checkout process. Once the user’s credentials are verified, the funds are simply transferred directly from the user’s bank account to the merchant’s account.

In the event of an international transaction outside of the EU, the buyer would first pay through the merchant’s third-party payment provider of choice, selecting Sofort as the payment method at checkout. The payment process proceeds normally until checkout is finalised. After this, the funds are transferred from the user’s bank account into the third-party payment provider’s local bank account. Subsequently, the funds are moved into the payment provider’s international accounts before being disbursed into the foreign seller’s bank account. This multi-step process ensures that secure online payments are maintained even in complex international transactions.

Currently, there are no fees for using some of Sofort’s payment services, including the app itself and certain BNPL options. However, as Sofort functions as a payment gateway, it employs various methods and rails to process transactions. Sofort’s transaction fees typically range from €0.10 + 1-2% to €0.25 + 3.29%.

When using Sofort as a payment method through a third-party payment service provider acting as an international payment gateway, additional costs such as setup fees, FX costs, and potential hidden costs may apply. These costs can impact the overall payment processing expenses, making it essential for businesses to consider them when planning their cross-border payments strategy.

Understanding Sofort’s fee structure is crucial for businesses aiming to optimise their online payment solutions and enhance their e-commerce payments strategy. By leveraging Sofort’s cost-effective transaction methods, businesses can offer user-friendly payment options to their customers while maintaining secure online payments.

To further improve your prospects in the European market, consider partnering with a robust and reliable third-party payment provider like Tazapay. We offer access to over 173 countries and are secured with 256-bit encryption, ensuring that every transaction is safe and secure. By integrating Tazapay as your international payment gateway, you can lower your transaction fees, enhance your payment processing capabilities and effectively manage cross-border payments.

Contact us to find out more

Sources

In the dynamic landscape of global commerce, the push towards digitalization is more pronounced than ever. Yet, amidst this digital revolution, cash retains its stronghold in several economies across the world. Bridging the gap between the digital and physical realms of commerce are voucher-based payments, a novel solution that caters to both the digital native and the cash-preferring customer.

The Mechanics Behind the Method

Voucher-based payments stand out as a beacon of innovation in the payment industry. At its core, this method involves a straightforward process: during an online checkout, the customer opts for a voucher-based payment method. In response, they receive a voucher — essentially a digital or printable code that specifies a payment amount. This code can then be taken to a physical location, such as a retail outlet, an ATM, or a convenience store, where the customer completes the transaction using cash.

Why Hybrid Payment Methods Are Gaining Traction

The advent of hybrid payment methods, with voucher-based payments at the forefront, represents a significant leap towards financial inclusivity and flexibility. These methods cater to a diverse audience, ensuring that those without access to traditional banking services or those wary of digital transactions can still participate in the e-commerce boom.

Easing Cross-Border Transactions

One of the most compelling advantages of voucher-based payments is their ability to streamline cross-border transactions. This system not only facilitates international commerce by accommodating local payment preferences but also circumvents the complexities associated with currency conversion and international banking regulations.

Success Stories from Around the Globe

The global appeal of voucher-based payments is evident in the success stories emerging from various countries. In Japan, where cash is a preferred payment method for a significant portion of the population, these payments bridge the gap to online shopping. Brazil's boleto bancario and Egypt's Fawry system highlight how voucher payments are pivotal in integrating digital payment solutions within markets traditionally dominated by cash transactions.

Voucher-based payments bring several advantages to the table:

Despite their benefits, voucher-based payments come with their own set of challenges:

Adopting voucher-based payment methods through platforms like Tazapay can significantly enhance a business's reach and operational efficiency. Tazapay's seamless API integration enables businesses to tap into new markets by offering flexible payment options that cater to a global audience.

For businesses aiming to break into international markets, understanding and integrating voucher-based payments can be a game-changer. This payment method not only meets the diverse needs of global consumers but also positions businesses as forward-thinking and customer-centric.

The evolution of payment methods is a testament to the ever-changing landscape of global commerce. Voucher-based payments emerge as a key player in this evolution, offering a bridge between the digital and physical worlds. By embracing these hybrid payment methods, businesses can unlock new opportunities in international markets, catering to a broader audience and driving global growth.

If you're looking to expand your business globally and cater to a wider array of payment preferences, consider the power of voucher-based payments. Contact Tazapay today to explore how we can help you navigate the complexities of international transactions and unlock new market potentials.

[contact us]

The digital era has opened a world of opportunities for businesses to go global. Yet, the unique digital evolution of each region and country has profoundly influenced consumer preferences in online payments. This diversity has given rise to local payment methods, designed specifically to align with the distinct consumer behaviors across the globe. Understanding what these local payment methods entail and the reasons behind their emergence is crucial for businesses looking to thrive in the international market.

As we embark on the journey to understand the intricacies of local payment options, it's essential to first navigate through the diverse payment landscape that cross-border payments encompass. These payment methods form the backbone of international commerce, facilitating seamless transactions across borders. Let's delve into the key payment options that businesses and consumers commonly utilize in a cross-border context:

Credit Cards: Universally accepted, credit cards stand as a cornerstone in cross-border transactions, offering convenience and security for buyers and sellers alike.

Wire Transfer: For direct bank-to-bank transactions, wire transfers offer a reliable method for transferring funds internationally, albeit often with higher fees and longer processing times.

Local Bank Transfer: Bridging the gap between traditional and digital, local bank transfers provide a method for customers to pay through their local banking systems, enhancing convenience without the need for international banking facilities.

Local Payment Options: Catering specifically to regional preferences and financial infrastructures, local payment options (or alternative payment methods) offer tailored solutions that resonate with the local consumer behavior, ensuring inclusivity and accessibility in the global marketplace.

Local payment methods, distinct from the conventional international payments like credit cards and bank transfers, cater to regional preferences and needs. Known variably as alternative payment methods (APMs), their development is influenced by a myriad of factors including existing infrastructures, consumer behavior, and government policies. The contrast between the Philippines and Ghana illustrates this diversity perfectly; while the Philippines has embraced eWallets for their unbanked population, Ghana leans towards Mobile Money services provided by telecom companies, showcasing the tailored evolution of payment solutions across different landscapes.

Incorporating local payment options into your cross-border payment gateway is not just a nod to customer diversity—it's a strategic move that propels your business forward. This approach does more than just acknowledge the varied preferences of your global customer base; it actively engages with them, offering solutions that are attuned to their specific needs and circumstances. Here are the key benefits of integrating local payment methods into your international payment infrastructure:

Enhanced Customer Experience: By offering payment options that customers are familiar with and trust, you significantly improve the user experience. This familiarity reduces friction at checkout, increasing the likelihood of completing a purchase.

Increased Market Penetration: Local payment methods open doors to new markets, especially in regions with a high preference for non-traditional payment solutions. This inclusivity allows you to reach a broader audience, tapping into previously inaccessible customer segments.

Higher Transaction Success Rates: Local payment options often boast higher success rates for transactions, owing to their compatibility with the regional banking infrastructure and regulatory environment. This leads to fewer failed transactions and a smoother payment process.

Competitive Advantage: Offering a diverse set of payment options can set you apart from competitors, making your platform the preferred choice for customers seeking convenience and flexibility in their payment methods.

Regulatory Compliance: By integrating local payment methods, you align with local regulations and financial practices, minimizing legal and operational risks associated with international transactions.

Reduced Costs: Local payments can be more cost-effective for both merchants and consumers, avoiding the high fees associated with international card payments and currency conversions.

As the digital economy continues to connect markets worldwide, the strategic incorporation of local payment options into your payment gateway is essential. It not only respects and caters to the preferences of a global customer base but also capitalizes on the unique opportunities presented by the varied financial landscapes across regions. Embrace the diversity of payment preferences to unlock a world of possibilities for your cross-border business.

Embracing local payment methods comes with its costs, a fundamental truth in the realm of international business. To ensure a smooth integration of these payment solutions onto your platform, it's crucial to evaluate the financial implications:

Setup Fees: Assess whether an initial investment is required to access the service.

Platform Fees: Understand the service's cost structure—whether it operates on a flat rate, transaction percentage, or a combination of both.

Payout Options: Consider the currency in which the provider will settle payments to your business account, and whether it aligns with your financial preferences or needs.

FX Rates: Analyze the exchange rates offered for conversions, especially if payouts are in a different currency than your primary business operations.

Gaining a comprehensive understanding of these expenses is key to selecting a payment gateway that aligns with your business objectives and budgetary constraints.

In navigating these costs, Tazapay emerges as a pivotal partner for businesses looking to expand their global footprint. Offering competitive pricing and seamless integration, Tazapay enables access to local payment options in over 80 countries, simplifying the process without the need for establishing local entities. This advantage allows businesses to rapidly adapt to market demands and consumer preferences, ensuring a cost-effective and efficient payment solution tailored to the needs of international commerce.

The landscape of local payment methods is as diverse as the regions they serve. Each area has cultivated solutions that resonate with its unique market dynamics:

This regional overview underscores the importance of choosing payment methods that align with the local consumer behavior and technological infrastructure.

Integrating local payment methods into your cross-border payment strategy is imperative for businesses targeting international markets. By offering payment options that cater to regional preferences, you can enhance customer experience, expand market reach, and improve conversion rates. With the support of partners like Tazapay, navigating the complexities of global payments becomes more manageable, allowing your business to thrive in the competitive landscape of international e-commerce.

Familiarising yourself with financial institutions in Singapore is crucial for the successful localization of your business. As one of the most dynamic financial hubs in Asia, Singapore offers a fertile ground for expanding your eCommerce business.

Read on for a full guide to 10 of the top banks in Singapore that are pivotal for your online payment gateway, and a quick overview of the payment landscape in the country.

The banking infrastructure in Singapore is not only steadily optimised for an increasingly digitised global economy but also well-integrated into the local populace. In 2022, Singapore topped the area of financial inclusion, beating powerhouse economies such as the United States, Britain, Hong Kong and Japan1, and attained a 92% internet penetration level in the country.2

This digital transformation is further supported by the government's proactive stance towards digitalisation, with initiatives such as PayNow and e-wallet integration enhancing Singapore's online payment gateway capabilities.

As such, the payments landscape in Singapore is largely digital, with card payments being the most popular online payment method. However, current trends in local payment solutions forecast that e-wallet payments will soon surpass cards by 2026, signalling a significant shift in consumer preferences.3

DBS Bank, the largest bank in Singapore by total assets (SGD 686 billion as of 2021), was founded in 1968 by the government of Singapore. The bank excels in providing a variety of financial products and services, including personal and business banking, investment banking, and wealth management. DBS Group champions electronic payment methods for its customers:

Most third-party international payment gateways, including Tazapay, support DBS's bank redirected payment methods and card payments, catering to eCommerce transactions. Incorporating the PayNow system enhances familiarity for Singaporean buyers, fostering trust for international merchants.

Founded in 1932, OCBC is the second-largest bank in Singapore with over SGD 542 billion in total assets as of 2020. It provides robust financial products and services suitable for a thriving digital economy:

UOB, ranking third in Singapore by assets with over SGD 459 billion (2021), has a prominent presence in the region, headquartered in the former tallest building in Southeast Asia. The bank offers:

A multinational presence since 1859, Standard Chartered Bank boasts over SGD 153 billion in total assets as of 2021 and is a trusted name among Singaporeans due to its long-standing reliability. The bank offers:

Maybank, a leading Southeast Asian bank with a strong Singapore presence (SGD 69 billion in assets as of 2021), operates over 2,600 branches across 18 countries. The bank offers:

Citibank, with SGD 52 billion in assets as of 2021, offers a diverse range of financial services, reinforcing its significant role in Singapore's banking sector. The bank offers:

HSBC, a global financial institution, holds approximately SGD 27 billion in assets as of 2021 and shares a historical lineage with Standard Chartered in British colonial history. The bank offers:

With a robust SGD 5.2 billion in assets (2021), the Bank of China marks China’s expanding influence in the Asian digital economy. The bank offers:

This Japanese banking leader, significant in Singapore, manages over SGD 5.2 billion in assets (2021) and has been a solid player since 1963. The bank offers:

Europe's largest banking group, BNP Paribas, holds about 3.7 billion SGD in total assets (2021) and maintains a strong European and global banking footprint. The bank offers:

With a clear understanding of the preferred banks in Singapore, you can better tailor your online business for the local market. Integrating with these banks through a payment gateway like Tazapay not only sets your business apart but also leverages localised payment methods to enhance customer trust.

Tazapay, operating with a 0.8%-2.5% fee for international transactions through local bank transfers, offers a compelling advantage for expanding your business in Singapore. Contact Tazapay today for more details and to take your business to the next level.

Sources

The digital landscape in the Philippines is undergoing a remarkable transformation, marked by a surge in e-commerce and digital payments. This evolution presents a golden opportunity for international businesses looking to expand their footprint in Southeast Asia. With the Philippines at the forefront of digital adoption, the market's potential for cross-border commerce is immense. Enter Dragonpay, a payment solution that is revolutionising how businesses access this vibrant and diverse market.

The Philippines is witnessing an e-commerce revolution, with growth rates outpacing many of its regional counterparts. A robust digital infrastructure, coupled with one of the world's highest social media usage rates, has created a fertile ground for digital commerce. This is further bolstered by a young, tech-savvy population that is increasingly inclined towards online shopping. The result? A growing e-commerce market ripe for international sellers.

Statistics underscore this potential: with internet penetration exceeding 70% and a digital payment adoption rate of 92%, the Philippines is not just a market—it's an opportunity. The country's e-commerce sector is expected to reach USD 29.57 billion by 2029, signaling a lucrative avenue for businesses aiming to tap into Southeast Asia. (https://www.mordorintelligence.com/industry-reports/philippines-ecommerce-market#:~:text=Philippines%20E%2Dcommerce%20Market%20Analysis,period%20(2024%2D2029).

Dragonpay is not just a payment platform; it's a bridge between the traditional and the digital, the local and the international. Founded to address the Philippines' unique market challenges, Dragonpay offers a plethora of payment solutions that cater to a wide array of consumers, including the significant unbanked population. By providing options beyond traditional banking, such as over-the-counter payments and online banking transfers, Dragonpay has become an integral part of the Philippine e-commerce ecosystem.

For international merchants, Dragonpay is a gateway to the Philippine market. It simplifies the complex landscape of local payments, enabling businesses to accept payments through methods preferred by Filipino consumers. This capability is crucial for cross-border transactions, where familiarity and trust in payment methods significantly influence consumer behaviour.

Dragonpay offers several compelling advantages for international businesses:

Success stories abound, from small online retailers who have expanded their market reach to multinational corporations that have streamlined their payment processes in the Philippines. These narratives underscore Dragonpay's role in enabling businesses to flourish in the Philippine digital marketplace.

For businesses seeking to leverage Dragonpay for cross-border sales, understanding the transaction process is crucial. Here's a breakdown of how Dragonpay works in conjunction with a payment gateway like Tazapay to enable international transactions:

This streamlined process simplifies the complexity of international payments, making it easier for sellers to access the Philippine market without navigating the intricacies of local banking and payment systems. By leveraging the capabilities of Dragonpay through a comprehensive payment gateway like Tazapay, businesses can ensure a smooth, secure, and efficient transaction process for both themselves and their customers.

Integrating Dragonpay as a payment option for your business requires partnering with a comprehensive payment gateway like Tazapay. Tazapay simplifies the process, enabling access not only to Dragonpay but also to a wide array of local payment options across more than 80 countries with a single integration. Here's how to get started:

Tazapay's dedicated support team is available to guide you through each step, from sign-up to integration, ensuring a smooth and efficient setup process. By choosing Tazapay as your payment gateway, you not only gain access to Dragonpay but also unlock the potential to expand your business reach globally, catering to a diverse customer base with localized payment options.

Cross-border sales come with their set of challenges, from navigating local payment preferences to addressing security concerns. Dragonpay is designed to mitigate these challenges by:

Providing a familiar payment interface for Filipino consumers, thus increasing conversion rates.

Offering robust fraud detection and prevention mechanisms to safeguard transactions.

Ensuring compliance with local regulations, reducing the administrative burden on merchants.

Preparing for the Future: Trends in Cross-Border E-Commerce

The landscape of cross-border e-commerce is constantly evolving. Emerging trends indicate a shift towards more personalized and secure online shopping experiences. Dragonpay stays ahead of these trends by continuously updating its platform with features that enhance user experience and security, ensuring businesses remain competitive in the dynamic Philippine e-commerce market.

Dragonpay is more than a payment gateway; it's a strategic tool for businesses aiming to capitalize on the Philippine e-commerce boom. Its comprehensive suite of services not only facilitates access to this lucrative market but also positions businesses for success in the global e-commerce arena.