Thailand is one of Southeast Asia’s fastest-growing digital economies. With a population that is increasingly mobile-first, digital payments are now part of everyday life. For international businesses selling to Thai customers, however, the biggest challenge remains checkout success.

Credit and debit cards remain important, but they often fall short. Many transactions are declined, card coverage is limited outside urban centers, and foreign exchange costs can discourage buyers. This results in abandoned checkouts and lost revenue opportunities.

PromptPay, Thailand’s national QR-based payment method overseen by the Bank of Thailand and National ITMX, has become the mainstream alternative. With more than 81 million registrations and billions of transactions every month, it is trusted by consumers across all sectors.

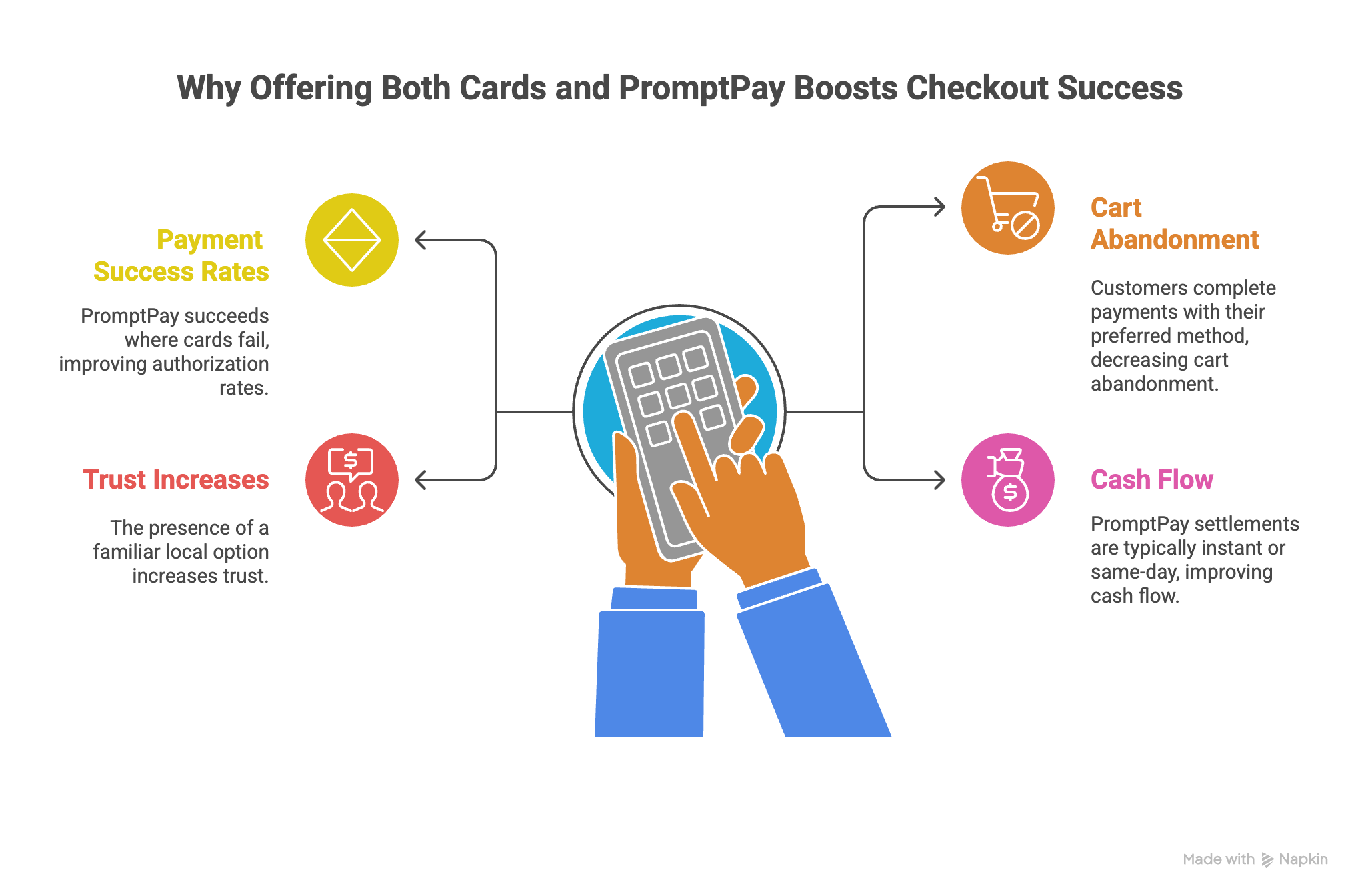

For global B2B and e-commerce businesses, enabling PromptPay alongside cards means fewer failed payments, higher authorization rates, and greater customer trust.

With Tazapay, you can offer PromptPay through a unified checkout that also supports cards and 80+ other local payment methods, going live within days.

PromptPay adoption has grown dramatically, making it an indispensable part of Thailand’s payment ecosystem:

This progression shows PromptPay’s journey from a domestic initiative to a critical tool for international businesses. Offering PromptPay at checkout has become an expectation, not a differentiator, for global merchants operating in Thailand.

.png)

E-commerce platforms and online marketplaces often see high cart abandonment in Thailand due to card failures or customer hesitation.

By offering PromptPay alongside cards:

PromptPay has become a default option for Thai shoppers, so businesses that include it maximize completed orders and revenue.

Thailand’s travel industry is huge, and online booking platforms often face failed transactions at checkout. This is particularly challenging for mid-range purchases like hotel reservations or tour bookings.

PromptPay helps by:

For online travel agencies and hotel platforms, PromptPay improves booking completion and reduces drop-offs.

Thailand has one of Asia’s most engaged digital populations, with significant spending on gaming and online products. But micro-transactions and one-off purchases often fail on card-only checkouts.

PromptPay ensures:

This makes PromptPay especially valuable for digital platforms, app stores, and gaming companies serving Thai customers.

As online education grows in Thailand, payment access remains a barrier. Many students and professionals lack international-ready cards, making it difficult to enroll in global courses.

PromptPay solves this by:

Businesses that provide multiple payment options serve more customers and reduce payment risk. In Thailand:

PromptPay complements cards rather than replacing them. Together, they capture the widest possible customer base and maximize checkout success.

Merchants relying only on cards or international transfers face:

Adding PromptPay addresses these risks and future-proofs your checkout strategy.

Tazapay simplifies the complexity of enabling PromptPay for cross-border businesses:

Whether you prioritize speed or brand control, Tazapay gives you the flexibility to add PromptPay and optimize checkout for higher authorization rates and faster settlement.

Thailand’s digital economy offers huge opportunities for global businesses, but only if they solve checkout friction. Cards remain necessary, but PromptPay has become an equally important option.

With more than 81 million registrations and over 2 billion monthly transactions in 2025, PromptPay is one of Thailand’s most trusted and widely used payment methods. Businesses that offer it alongside cards increase conversions, reduce abandonment, and build stronger customer trust.

With Tazapay, you can integrate PromptPay quickly and compliantly, enabling a better checkout experience for your Thai customers.

Ready to start? Talk to Tazapay and enable PromptPay today.

South Korea is a global leader in digital commerce, boasting one of the highest internet penetration rates and mobile adoption rates in the world.

However, succeeding in this digitally advanced economy demands more than just offering international card acceptance — it requires local adaptation, especially when it comes to payments.

Unlike Western markets where Visa, Mastercard, and PayPal dominate, Korean consumers strongly prefer domestic payment options.

More than 70% of online transactions in South Korea are processed through local digital wallets such as NaverPay, KakaoPay, and SamsungPay.

Recognizing this need for localization, Tazapay now enables merchants to offer Korea’s most trusted local payment methods — making entry into the Korean market simpler, faster, and operationally efficient.

International merchants can now accept payments through:

Through a single integration with Tazapay, businesses can offer these payment methods without needing to establish a local entity, open domestic bank accounts, or sign separate acquiring contracts.

South Korean consumers expect — and often require — familiar domestic payment methods at checkout.

Failure to offer recognizable options results in:

Conversely, merchants who localize their checkout experience by offering domestic wallets and local cards see:

The message is clear: adapting to local payment preferences isn't just operationally smart — it's commercially critical.

Tazapay’s platform architecture is built to remove traditional barriers to global expansion.

Through Tazapay, merchants can:

This Collect-Hold-Pay capability — unified under one platform — allows merchants to manage incoming funds and outgoing disbursements without multiple vendor relationships, reconciliations, or compliance overhead.

Simpler Onboarding:

Checkout Localization:

Optimized FX Management:

Improved Cash Flow:

Reduced Compliance Risk:

Operational Simplicity:

By centralizing these capabilities, merchants save on setup costs, legal complexity, and operational drag — accelerating their ability to capture market share in Korea.

South Korea continues to be a high-growth, digitally sophisticated market.

Mobile payments, domestic digital wallets, and local payment rails are the standard — not the exception — for Korean consumers.

International merchants who localize their payment strategies now will be better positioned to:

With Tazapay’s latest launch, expanding into South Korea has never been simpler.

One platform. One contract. Full access to Korea’s preferred payment options — without local entity setup or operational complexity.

👉 Start collecting Korean local payments today with Tazapay.

In the rapidly evolving digital economy of East Asia, understanding local payment methods is crucial for businesses aiming to penetrate these markets. With a significant portion of consumers favoring digital wallets and alternative payment solutions over traditional card systems, adapting to these preferences is essential for both local and international enterprises. This comprehensive guide delves into the most preferred payment methods across key East Asian countries, highlighting their penetration rates, ease of use, and strategic advantages for businesses.

Alipay, launched by Alibaba Group in 2004, has grown into one of the world's largest mobile payment platforms. It offers a comprehensive suite of financial services, including payments, money transfers, and wealth management. As of 2025, Alipay boasts over 1.2 billion users globally, with a significant concentration in China. Users can effortlessly link their bank accounts or cards to the app, facilitating seamless QR code-based transactions both online and offline. For international businesses, integrating Alipay as a payment option opens access to a vast consumer base accustomed to this platform, enhancing transaction convenience and customer trust. Notably, American Express has partnered with Alipay, allowing global cardholders to link their cards to the Alipay digital wallet, simplifying transactions for travelers and providing local businesses with greater opportunities to attract international customers.

Embedded within the ubiquitous WeChat app, WeChat Pay has seamlessly integrated social media with financial transactions. With over 1.3 billion monthly active users, WeChat Pay facilitates peer-to-peer transfers, bill payments, and in-store purchases through QR codes (source). Its integration into daily communication platforms makes it indispensable in Chinese consumers' lives. International businesses targeting Chinese customers can leverage WeChat Pay to offer a familiar and efficient payment method, thereby enhancing user experience and potentially increasing conversion rates.

UnionPay, established in 2002, is China's largest card payment organization, with cards accepted in over 180 countries. While digital wallets dominate urban areas, UnionPay remains prevalent, especially among older demographics and in regions where mobile payments are less ubiquitous. For businesses, supporting UnionPay ensures accessibility to a broader audience, including those who prefer traditional card payments. Additionally, UnionPay's collaboration with various international payment networks facilitates smoother cross-border transactions.

Introduced in 2018, PayPay has rapidly become one of Japan's leading mobile payment apps, boasting over 50 million users. It offers QR code-based payments, promotions, and a user-friendly interface, encouraging cash-reliant consumers to adopt digital payments. For international businesses, integrating PayPay can attract Japanese customers who prefer this method, especially in e-commerce and retail sectors. Its growing acceptance across various merchants signifies a shift towards cashless transactions in Japan.

Rakuten Pay, part of the Rakuten ecosystem, allows users to make payments using linked credit cards or Rakuten points. Its integration with Rakuten's e-commerce platform provides a seamless shopping experience. International businesses partnering with Rakuten Pay can tap into a loyal customer base familiar with Rakuten's services, enhancing brand visibility and trust. The platform's reward system, offering Rakuten points for transactions, incentivizes repeat purchases.

Originally designed for public transport payments, IC cards like Suica and PASMO are now widely accepted at convenience stores, restaurants, and vending machines across Japan. Merchants benefit from their simplicity—transactions are instant, reducing checkout times significantly. Retailers near transit hubs can capitalize on the popularity of IC cards by offering exclusive discounts or promotions for card users. Suica cards are also compatible with Apple Pay, enhancing their appeal among international tourists.

KakaoPay, launched by Kakao Corporation, integrates seamlessly with KakaoTalk, South Korea's dominant messaging app. It offers services like money transfers, bill payments, and online purchases. With over 36 million users, KakaoPay's convenience and integration into daily communication make it a preferred payment method. International businesses can benefit by incorporating KakaoPay, appealing to tech-savvy consumers who value efficiency and integration. Its rapid adoption reflects South Korea's shift towards a cashless society.

Naver Pay, associated with Naver, South Korea's leading search engine, provides users with a simple payment solution for online shopping and services. By linking bank accounts or cards, users can make swift payments without repeatedly entering payment information. For businesses, integrating Naver Pay can enhance the checkout experience for customers, potentially reducing cart abandonment rates. Its association with Naver's extensive ecosystem offers additional marketing opportunities.

Toss started as a peer-to-peer money transfer service and has expanded into a comprehensive financial platform, including payments, investments, and insurance. With over 20 million users, Toss's user-centric design and broad service offerings make it a significant player in South Korea's fintech scene. Businesses can leverage Toss to offer diverse financial services, catering to consumers seeking integrated financial solutions.

Samsung Pay stands out with its compatibility with both NFC-enabled terminals and traditional magnetic stripe readers via MST technology. This versatility makes it a favorite among South Korean consumers and tourists alike. Merchants benefit from its broad acceptance and secure transaction protocols that minimize chargebacks. Retailers adopting Samsung Pay can cater to a diverse customer base without upgrading their POS systems extensively. Its widespread acceptance makes it an essential payment method for businesses serving South Korean consumers.

Initially launched as a transit card, Octopus has become a widely accepted payment method across Hong Kong, from retail stores to restaurants. Users can top up their cards via cash or digital means, making it an easy-to-use solution for both locals and tourists. Businesses accepting Octopus tap into a vast consumer base familiar with contactless payments.

A localized version of Alipay, AlipayHK serves Hong Kong residents with seamless mobile payments. With over 3 million users, it is commonly used for peer-to-peer transfers, bill payments, and online shopping. Businesses integrating AlipayHK can attract local customers accustomed to digital payments.

WeChat Pay HK offers similar functionality to WeChat Pay in mainland China, with support for local transactions in Hong Kong dollars. It allows businesses to cater to both Hong Kong residents and visiting mainland Chinese consumers who rely on WeChat Pay for everyday transactions.

JKoPay is Taiwan’s leading QR-code-based wallet, with strong adoption in retail and small businesses. JKoPay enables small businesses to go cashless by providing an easy-to-use platform for accepting digital payments. Its growing user base makes it a valuable payment option for businesses expanding into Taiwan.

Line Pay is Taiwan’s most used mobile wallet, embedded in the Line messaging app. With seamless integration into e-commerce platforms, businesses can drive higher conversion rates and customer retention.

Taiwan Pay, backed by the government, promotes financial inclusion and cashless transactions. Businesses accepting Taiwan Pay can cater to a broader audience, including the growing digital-native population.

For merchants eyeing East Asia's lucrative markets, adopting local payment methods is no longer optional—it’s essential for success in this diverse region where consumer preferences vary widely by country but consistently favor convenience and familiarity over global alternatives like credit cards.

By integrating these local payment solutions into their operations, businesses can not only enhance customer satisfaction but also unlock new revenue streams in one of the world’s most dynamic consumer markets!

Local payment methods and e-wallets dominate Southeast Asia’s digital economy, far outpacing credit card adoption. Consumers across the region rely on QR payments, bank transfers, and mobile wallets for everyday transactions due to their convenience, security, and accessibility. For businesses, accepting these preferred payment options is crucial for expanding reach and driving growth. This guide breaks down the most widely used local payment methods in Singapore, Thailand, Indonesia, Malaysia, Vietnam, and the Philippines, offering insights into how they shape the region’s fast-evolving payment landscape.

1. PayNow

PayNow is Singapore’s real-time bank transfer system that allows users to send money instantly using mobile numbers or UENs (Unique Entity Numbers). Widely adopted for both personal and business transactions, it has become a cornerstone of Singapore's cashless society. Users appreciate its simplicity—by linking their bank accounts to their mobile numbers and scanning an SGQR (a unified QR code) completes transactions instantly without additional fees. For international businesses, integrating PayNow can streamline transactions with Singaporean consumers and partners, facilitating smoother financial operations.

2. GrabPay

Integrated within the Grab super-app, GrabPay offers services ranging from ride-hailing to food delivery and in-store purchases. Its widespread acceptance and user-friendly interface have made it a popular choice among Singaporeans. Users can easily top up their GrabPay wallets and make payments by scanning QR codes, ensuring swift transactions. International businesses can tap into GrabPay's extensive user base by offering it as a payment option, thereby enhancing customer reach and satisfaction.

3.DBS PayLah!

DBS PayLah! is a mobile wallet service by DBS Bank, one of Singapore's leading financial institutions. It enables users to perform a variety of transactions, from bill payments to peer-to-peer transfers. The app's integration with Singapore's national QR code standard (SGQR) ensures compatibility with numerous merchants, enhancing its utility. For businesses, integrating DBS PayLah! can provide access to a broad customer base, particularly those who prefer using bank-affiliated payment solutions.

4. FavePay

FavePay is a mobile payment app that rewards users with instant cashback at participating merchants. Popular among deal-seekers in Singapore, it enhances the shopping experience with its rewards program. Users can make payments by scanning QR codes and enjoy immediate discounts, fostering customer loyalty. Businesses can benefit from increased patronage by partnering with FavePay and participating in its promotional campaigns.

1. PromptPay

PromptPay is Thailand's government-backed real-time payment system that links mobile numbers or national ID numbers to bank accounts, facilitating instant transfers. Widely used for both personal and business transactions, it supports e-commerce payments and utility bill settlements. Its interoperability with Singapore’s PayNow for cross-border transfers enhances its utility for international transactions. For businesses, integrating PromptPay can simplify payment processes and help reduce transaction costs.

2. ShopeePay

Integrated with Southeast Asia’s top e-commerce platform, ShopeePay enables QR payments for online and offline shopping. Recently, it became a payment option for Apple services in Thailand, enhancing its utility beyond e-commerce. ShopeePay’s widespread acceptance at partner merchants makes it a preferred choice for consumers and businesses seeking convenience.

3. WeChat Pay

WeChat Pay is popular among Chinese tourists in Thailand but has also gained traction among local users due to its seamless QR-based payment system at major retailers and restaurants. It facilitates cross-border payments in multiple currencies, making it ideal for international travelers. Businesses catering to tourists can benefit from accepting WeChat Pay, enhancing the payment experience for foreign customers.

4. TrueMoney Wallet

With 16.8% market share, TrueMoney offers low fees (acceptance fee of only 1% of the transaction value, compared to costlier cards transaction fees) and supports utility bills, gaming, and cross-border remittances to Cambodia and Myanmar. Its versatility makes it a staple for both personal and business transactions. For businesses, integrating TrueMoney Wallet can attract cost-conscious consumers seeking affordable payment options other than cards.

5. Rabbit LINE Pay

A collaboration between Rabbit, the BTS Skytrain's payment system, and LINE, a popular messaging app, Rabbit LINE Pay offers a seamless payment experience. Users can pay for public transportation, shop online, and make in-store purchases using the service. The integration with LINE's platform allows for peer-to-peer transfers and bill splitting among friends. Its rewards program incentivizes usage through points and cashback offers. The service's user-friendly interface and widespread merchant acceptance have contributed to its rapid growth.

1. QRIS (Quick Response Indonesian Standard)

QRIS is Indonesia’s unified QR code system that integrates multiple banks and e-wallets under one standard. It simplifies cashless transactions for consumers by allowing them to use their preferred wallet or banking app at any QRIS-enabled merchant. For businesses, QRIS reduces operational complexity by eliminating the need for multiple QR codes. Merchants benefit from its interoperability across 22.4 million merchants nationwide, while consumers enjoy seamless payments for everything from groceries to transportation.

2. OVO

OVO is a versatile e-wallet widely used for ride-hailing services (Grab), bill payments, and retail transactions. Its cashback rewards program attracts younger demographics, while merchants benefit from its extensive integration across platforms.

3. DOKU

Doku Wallet is a pioneer in Indonesia’s digital payments space, offering virtual accounts for online transactions. It caters to both consumers and merchants by providing flexible payment options like ATM transfers and mobile banking, making it ideal for e-commerce businesses targeting customers who prefer traditional banking methods.

4. LinkAja

LinkAja focuses on essential services like transportation tolls, utilities, and retail shopping while aligning with the national QRIS standard for interoperability. Businesses targeting middle-income consumers find LinkAja particularly useful due to its government backing.

5. Dana

Dana is a secure e-wallet offering features like bill payments, fund transfers, and QR code scanning for transactions. Its user-friendly interface makes it popular among consumers seeking convenience in day-to-day payments.

6. GoPay

Originating from Gojek, Indonesia's multi-service platform, GoPay has become one of the country's leading digital wallets. Users can pay for services like transportation, food delivery, and online shopping. The wallet's integration with Gojek's ecosystem offers users a seamless payment experience. GoPay's peer-to-peer transfer feature allows users to send money to friends and family effortlessly. Its partnership with various financial institutions has expanded its services to include insurance and investment products.

1. FPX (Financial Process Exchange)

FPX is Malaysia's national real-time retail payments platform, facilitating secure online bank transfers. It's widely used for high-value transactions and is favored by both consumers and businesses due to its reliability and low fees. FPX's integration with major e-commerce platforms and its oversight by Bank Negara Malaysia make it a trusted payment method for online purchases, bill payments, and fund transfers.

2. Touch 'n Go eWallet:

Initially developed for toll payments on Malaysia's highways, Touch 'n Go eWallet has evolved into a versatile digital payment solution that caters to a wide range of consumer needs. It now supports retail shopping, bill payments, and even cross-border QR transactions in Singapore. The platform integrates seamlessly with merchants, allowing businesses to accept payments via QR codes and streamline checkout processes. Consumers benefit from its user-friendly interface, cashback rewards, and promotions, which incentivize frequent usage. Its ability to handle both online and offline transactions makes it ideal for everyday expenses, from groceries to entertainment.

3. Boost:

Boost is a gamified digital payment platform that has rapidly gained popularity among younger Malaysians. It offers cashback rewards, digital vouchers, and exclusive promotions for transactions across various sectors such as retail shopping, bill payments, and food delivery. Boost’s unique “Shake” feature adds an element of fun by allowing users to earn instant rewards after every transaction. The platform is particularly appealing to small businesses and micro-entrepreneurs due to its low-cost setup and ability to attract tech-savvy customers.

4. MAE by Maybank:

MAE (Maybank Anytime Everyone) is an innovative lifestyle app offered by Maybank that combines traditional banking services with modern financial tools. Beyond its function as a digital wallet for payments and transfers, MAE includes features like budgeting tools, savings goals, expense tracking, and even a virtual debit card for online shopping. These features make MAE particularly appealing to consumers who want greater control over their finances while enjoying the convenience of cashless payments. For businesses, MAE provides seamless integration with Maybank’s merchant services, enabling them to accept payments from one of Malaysia’s largest banking customer bases.

1. Momo Wallet

Momo leads Vietnam's e-wallet market with over 31 million users. It offers a comprehensive suite of services including bill payments, money transfers, and even investment options. Momo's popularity stems from its user-friendly interface and extensive merchant network. For businesses, integrating with Momo provides access to a large, engaged user base and can significantly boost sales, especially in sectors like food delivery and e-commerce.

2. VNPT EPAY

VNPT EPAY, backed by Vietnam's telecom giant VNPT Group, operates an extensive network of over 2,100 transaction points nationwide. It specializes in utility bill payments, mobile top-ups, and retail transactions. VNPT EPAY's wide reach makes it particularly valuable for businesses targeting consumers in both urban and rural areas. The platform's integration with various service providers simplifies bill payments for millions of Vietnamese households.

3. ZaloPay

ZaloPay leverages its integration with Zalo, Vietnam's most popular messaging app, to provide seamless payment services. Users can easily send money, pay bills, and make purchases without leaving the Zalo ecosystem. This integration makes ZaloPay particularly attractive for social commerce and peer-to-peer transactions. Businesses can benefit from ZaloPay's social features to enhance customer engagement and drive sales.

1. QR Ph

QR Ph is the Philippines' national QR code standard, designed to promote interoperability among various payment service providers. It allows users to make payments using any participating e-wallet or banking app by scanning a single QR code. For businesses, adopting QR Ph simplifies payment acceptance and reduces the need for multiple QR codes at the point of sale. This standardization is expected to accelerate the adoption of cashless payments across the country.

2.GrabPay

GrabPay has become integral to the Philippines' digital payment landscape, offering a seamless experience for Grab's ride-hailing and food delivery services. It has expanded to include bill payments, online shopping, and even investments. GrabPay's loyalty program, which offers points for every transaction, has been a key driver of user adoption. For merchants, GrabPay provides access to Grab's large user base and detailed analytics to help optimize their businesses.

3.ShopeePay

ShopeePay has leveraged Shopee's e-commerce dominance to become a major player in the Philippines' digital payment space. It offers cashback rewards, discounts, and seamless checkout experiences on the Shopee platform. ShopeePay has also expanded to offline merchants, particularly in partnership with convenience stores like 7-Eleven. This omnichannel approach makes ShopeePay an attractive option for businesses looking to reach customers both online and offline.

4.Maya (formerly PayMaya)

Maya has evolved from a simple e-wallet into a comprehensive financial services platform. It offers features like a savings account, cryptocurrency trading, and micro-investments alongside traditional payment services. Maya's all-in-one approach appeals to tech-savvy Filipinos looking for a unified financial solution. For businesses, Maya provides robust payment APIs and plugins for easy integration into various e-commerce platforms.

Southeast Asia's diverse and rapidly evolving payment landscape presents both opportunities and challenges for businesses. Understanding and integrating local payment methods is crucial for success. As this guide has highlighted, each country boasts a unique blend of digital wallets, real-time payment systems, and traditional methods, all shaping consumer preferences and business operations.

By partnering with Tazapay, businesses gain a significant advantage in navigating this complex landscape. Tazapay's localized payment rails enable you to offer popular methods like PayNow, FPX, and QRIS without needing local entities, streamlining cross-border transactions and reducing operational overhead. With multi-currency support, high conversion rates, and advanced fraud management, Tazapay empowers businesses to tap into Southeast Asia's growing digital economy with confidence.

The Australian e-commerce market continues to show significant growth. In 2024, the market is projected to reach a revenue figure of $35.92 billion. This represents a continuation of the rapid growth seen in previous years, fueled by various factors including the increasing preference for online shopping among Australian households and the rise of digital payment solutions like POLi. Additionally, the Australian eCommerce market is expected to grow at a compound annual growth rate (CAGR) of 8.33%, reaching $49.47 billion in sales by 2028.

The Rise of POLi in Australian E-commerce

POLi has carved a niche as one of the most preferred online payment options in Australia, facilitating seamless Pay Anyone internet banking payments. Its integration with Australia Post’s robust infrastructure lends it unparalleled reliability and trust, making it a cornerstone of the digital payments landscape in the region.

How POLi Works

At its core, POLi enables users to conduct direct funds transfers from their bank accounts to merchants without the need for credit cards. This simplicity of use, coupled with the elimination of the need for a traditional account registration process, positions POLi as a user-friendly payment gateway for Australians and international merchants alike.

Instantaneous Transactions

POLi Payments are distinguished for their rapid processing, where transactions, particularly through POLi PayID, are completed almost instantly. This efficiency is paramount for businesses that prioritise quick turnaround times and for consumers who value speed in their online transactions.

Security Assured

With regular security reviews and the use of 2048-bit encrypted SSL certificates, POLi assures the utmost privacy and security for its users. Sensitive information, such as usernames and passwords, are never stored, providing a safe transaction environment.

No Registration Needed

POLi simplifies the online payment process by eliminating the need for account registration. Users can select POLi at checkout, facilitating a smoother and faster transaction process, enhancing the overall user experience.

Facilitating Cross-Border Payments

For international merchants eyeing the Australian market, POLi serves as an essential bridge, enabling direct payments from any Australian bank. This multi-bank redirect capability ensures merchants can offer a localized payment solution, essential for tapping into Australia's lucrative e-commerce sector.

The Checkout Process with POLi

Within Australia and New Zealand:

For International Transactions:

Region-locked

One of the primary drawbacks of POLi is its availability, which is currently limited to Australia and New Zealand. This regional exclusivity can pose challenges for international transactions, necessitating a third-party payment provider for global merchants.

Internet Reliant

Given Australia's vast landscape and varied internet connectivity, the online nature of POLi Payments means that transactions may sometimes be hindered by network stability issues, affecting the consistency of the payment experience.

POLi endeavors to keep costs low, charging a modest 1.25% per transaction, capped at 3%, and a flat fee of AUD 0.95 for PayID payments. While third-party payment providers may introduce additional costs, the overall affordability of POLi transactions remains a significant advantage for businesses and consumers.

Market Penetration Strategies

Adopting POLi can dramatically enhance an international merchant's appeal to Australian consumers, offering a familiar and trusted payment method. This localization strategy not only boosts sales but also builds consumer trust and loyalty.

Enhancing Customer Experience with POLi

Integrating POLi into your payment options can significantly streamline the checkout process, reducing cart abandonment rates and elevating the overall shopping experience. The convenience and security of POLi payments encourage repeat business, fostering a loyal customer base.

In Australia's dynamic e-commerce environment, POLi Payments emerges as a pivotal solution for businesses aiming to capitalize on digital market opportunities. Its integration into international payment gateways offers a seamless, secure, and user-friendly transaction process, vital for tapping into Australia's growing online consumer base.

Ready to Embrace the Future of Payments?

Exploring POLi as part of your payment solutions is more than just offering another payment method; it's about unlocking the full potential of the Australian e-commerce market. For international merchants, the journey towards maximizing e-commerce success in Australia starts with understanding and implementing localized payment methods like POLi. Discover how integrating POLi Payments can transform your business and contact Tazapay for seamless international transactions today.

Familiarising yourself with financial institutions in Singapore is crucial for the successful localization of your business. As one of the most dynamic financial hubs in Asia, Singapore offers a fertile ground for expanding your eCommerce business.

Read on for a full guide to 10 of the top banks in Singapore that are pivotal for your online payment gateway, and a quick overview of the payment landscape in the country.

The banking infrastructure in Singapore is not only steadily optimised for an increasingly digitised global economy but also well-integrated into the local populace. In 2022, Singapore topped the area of financial inclusion, beating powerhouse economies such as the United States, Britain, Hong Kong and Japan1, and attained a 92% internet penetration level in the country.2

This digital transformation is further supported by the government's proactive stance towards digitalisation, with initiatives such as PayNow and e-wallet integration enhancing Singapore's online payment gateway capabilities.

As such, the payments landscape in Singapore is largely digital, with card payments being the most popular online payment method. However, current trends in local payment solutions forecast that e-wallet payments will soon surpass cards by 2026, signalling a significant shift in consumer preferences.3

DBS Bank, the largest bank in Singapore by total assets (SGD 686 billion as of 2021), was founded in 1968 by the government of Singapore. The bank excels in providing a variety of financial products and services, including personal and business banking, investment banking, and wealth management. DBS Group champions electronic payment methods for its customers:

Most third-party international payment gateways, including Tazapay, support DBS's bank redirected payment methods and card payments, catering to eCommerce transactions. Incorporating the PayNow system enhances familiarity for Singaporean buyers, fostering trust for international merchants.

Founded in 1932, OCBC is the second-largest bank in Singapore with over SGD 542 billion in total assets as of 2020. It provides robust financial products and services suitable for a thriving digital economy:

UOB, ranking third in Singapore by assets with over SGD 459 billion (2021), has a prominent presence in the region, headquartered in the former tallest building in Southeast Asia. The bank offers:

A multinational presence since 1859, Standard Chartered Bank boasts over SGD 153 billion in total assets as of 2021 and is a trusted name among Singaporeans due to its long-standing reliability. The bank offers:

Maybank, a leading Southeast Asian bank with a strong Singapore presence (SGD 69 billion in assets as of 2021), operates over 2,600 branches across 18 countries. The bank offers:

Citibank, with SGD 52 billion in assets as of 2021, offers a diverse range of financial services, reinforcing its significant role in Singapore's banking sector. The bank offers:

HSBC, a global financial institution, holds approximately SGD 27 billion in assets as of 2021 and shares a historical lineage with Standard Chartered in British colonial history. The bank offers:

With a robust SGD 5.2 billion in assets (2021), the Bank of China marks China’s expanding influence in the Asian digital economy. The bank offers:

This Japanese banking leader, significant in Singapore, manages over SGD 5.2 billion in assets (2021) and has been a solid player since 1963. The bank offers:

Europe's largest banking group, BNP Paribas, holds about 3.7 billion SGD in total assets (2021) and maintains a strong European and global banking footprint. The bank offers:

With a clear understanding of the preferred banks in Singapore, you can better tailor your online business for the local market. Integrating with these banks through a payment gateway like Tazapay not only sets your business apart but also leverages localised payment methods to enhance customer trust.

Tazapay, operating with a 0.8%-2.5% fee for international transactions through local bank transfers, offers a compelling advantage for expanding your business in Singapore. Contact Tazapay today for more details and to take your business to the next level.

Sources

The digital landscape in the Philippines is undergoing a remarkable transformation, marked by a surge in e-commerce and digital payments. This evolution presents a golden opportunity for international businesses looking to expand their footprint in Southeast Asia. With the Philippines at the forefront of digital adoption, the market's potential for cross-border commerce is immense. Enter Dragonpay, a payment solution that is revolutionising how businesses access this vibrant and diverse market.

The Philippines is witnessing an e-commerce revolution, with growth rates outpacing many of its regional counterparts. A robust digital infrastructure, coupled with one of the world's highest social media usage rates, has created a fertile ground for digital commerce. This is further bolstered by a young, tech-savvy population that is increasingly inclined towards online shopping. The result? A growing e-commerce market ripe for international sellers.

Statistics underscore this potential: with internet penetration exceeding 70% and a digital payment adoption rate of 92%, the Philippines is not just a market—it's an opportunity. The country's e-commerce sector is expected to reach USD 29.57 billion by 2029, signaling a lucrative avenue for businesses aiming to tap into Southeast Asia. (https://www.mordorintelligence.com/industry-reports/philippines-ecommerce-market#:~:text=Philippines%20E%2Dcommerce%20Market%20Analysis,period%20(2024%2D2029).

Dragonpay is not just a payment platform; it's a bridge between the traditional and the digital, the local and the international. Founded to address the Philippines' unique market challenges, Dragonpay offers a plethora of payment solutions that cater to a wide array of consumers, including the significant unbanked population. By providing options beyond traditional banking, such as over-the-counter payments and online banking transfers, Dragonpay has become an integral part of the Philippine e-commerce ecosystem.

For international merchants, Dragonpay is a gateway to the Philippine market. It simplifies the complex landscape of local payments, enabling businesses to accept payments through methods preferred by Filipino consumers. This capability is crucial for cross-border transactions, where familiarity and trust in payment methods significantly influence consumer behaviour.

Dragonpay offers several compelling advantages for international businesses:

Success stories abound, from small online retailers who have expanded their market reach to multinational corporations that have streamlined their payment processes in the Philippines. These narratives underscore Dragonpay's role in enabling businesses to flourish in the Philippine digital marketplace.

For businesses seeking to leverage Dragonpay for cross-border sales, understanding the transaction process is crucial. Here's a breakdown of how Dragonpay works in conjunction with a payment gateway like Tazapay to enable international transactions:

This streamlined process simplifies the complexity of international payments, making it easier for sellers to access the Philippine market without navigating the intricacies of local banking and payment systems. By leveraging the capabilities of Dragonpay through a comprehensive payment gateway like Tazapay, businesses can ensure a smooth, secure, and efficient transaction process for both themselves and their customers.

Integrating Dragonpay as a payment option for your business requires partnering with a comprehensive payment gateway like Tazapay. Tazapay simplifies the process, enabling access not only to Dragonpay but also to a wide array of local payment options across more than 80 countries with a single integration. Here's how to get started:

Tazapay's dedicated support team is available to guide you through each step, from sign-up to integration, ensuring a smooth and efficient setup process. By choosing Tazapay as your payment gateway, you not only gain access to Dragonpay but also unlock the potential to expand your business reach globally, catering to a diverse customer base with localized payment options.

Cross-border sales come with their set of challenges, from navigating local payment preferences to addressing security concerns. Dragonpay is designed to mitigate these challenges by:

Providing a familiar payment interface for Filipino consumers, thus increasing conversion rates.

Offering robust fraud detection and prevention mechanisms to safeguard transactions.

Ensuring compliance with local regulations, reducing the administrative burden on merchants.

Preparing for the Future: Trends in Cross-Border E-Commerce

The landscape of cross-border e-commerce is constantly evolving. Emerging trends indicate a shift towards more personalized and secure online shopping experiences. Dragonpay stays ahead of these trends by continuously updating its platform with features that enhance user experience and security, ensuring businesses remain competitive in the dynamic Philippine e-commerce market.

Dragonpay is more than a payment gateway; it's a strategic tool for businesses aiming to capitalize on the Philippine e-commerce boom. Its comprehensive suite of services not only facilitates access to this lucrative market but also positions businesses for success in the global e-commerce arena.